We’ve been neutral in a 0.7130-0.7240 range for Kiwi dollar against US dollar.

NZDUSD in medium term perspectives: The Fed’s tightening cycle plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar, pushing NZDUSD down to 0.7000 or lower. Granted, the NZ economy is strong and dairy prices have risen, but these forces are subservient to the US dollar’s trend.

We expect NZD to fall through this year, reaching 0.62 at year-end. The support to growth from migration will fade, while the RBNZ -at the very least–are likely to hold rates steady as inflation normalizes, pushing real rates materially lower. The economy is also now subject to credit tightening through numerous channels: macro-prudential constraints, widening mortgage rate spreads, and banks’ discretionary tightening of credit criteria to businesses. We now expect the RBNZ to be on hold this year, but there is a clear downside risk to the OCR in the near term.

Although the Kiwi dollar surged a bit in the recent times but sensing more bearish pressures in the upcoming future especially after data showed that China’s imports surged more than expected but printed lower comparatively with previous period and the greenback remained supported by hawkish US central bank’s tone.

The FOMC remained on hold, which seems momentary, at 0.50%-0.75%. There was little fresh news in the statement that carries hawkish tone - risks are still seen "roughly balanced", activity is expected to expand at a "moderate pace" and that warrants "only gradual increases" in rates.

The Fed conceded that the sentiment surveys have firmed: "Measures of consumer and business sentiment have improved of late" and their confidence on inflation has firmed a touch, the Fed noting: "inflation will rise to 2 pct" (vs "Inflation is expected to rise to 2 pct" previously). Otherwise, current conditions are largely unchanged, job gains are still considered "solid" and activity is growing at a "moderate pace". There are no strong clues here that the Fed is agitating to hike in March.

OTC outlook and hedging framework:

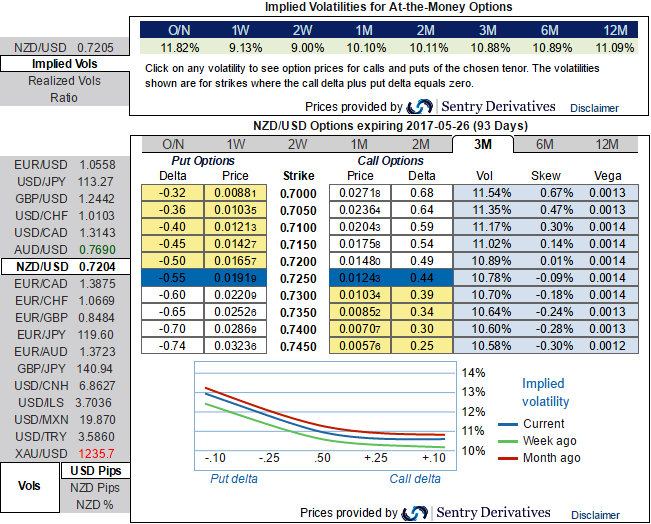

You could notice OTC market discounting these factors in 3m IV skews (they bid for OTM put strikes).

Well, to mitigate the further bearish risks, at spot reference 0.7205 we reckon the NZDUSD options strips with narrowed tenors.

Hence, we advocate initiating longs in 2 lots of 3m -0.49 delta put options, while buying 1 lot of +0.51 delta calls of 1m expiry at net debit.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?