Since last week, the ECB presented a surprising policy modification by reducing key monetary policy rates, the president Mario Draghi also mentions that this would probably ECB's last policy rate cut from here onwards until near future.

The ECB had also reached the lower bound on policy rates and then changed it later. Still, the signalling effect from yesterday’s meeting was very clear. Arguably, lower interest rates are the most direct way to influence the exchange rate.

So for now,, the European central bank seems to have exited the currency war, which it entered in 2014, and instead is focusing on the credit/bank lending channel.

We believe the ECB’s shift from targeting the exchange rate to targeting the credit/bank lending channel is a sensible step. There is a limited pass-through from negative policy rates to household deposit rates.

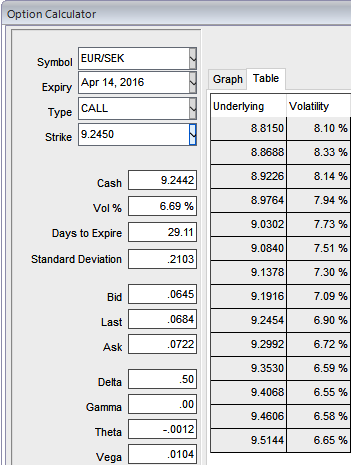

We recommended buying a 3M EUR/SEK ATM -0.50 delta put option (IVs at 7.34%) financed by shorting a 1M EUR/SEK 9..44-9.10 strangle.

We see limited short-term upside potential for the SEK in the near month as 1M EUR/SEK implied volatility is extremely lower (see diagram for 1M ATM call at 6.69%) and with the theta risk (i.e. time decay) would likely to shrink away as there is downside potential currently. Limited upside risks to EUR/SEK keeps theta becoming cheaper.

We believe Swedish fundamentals have continued to surprise on the upside while the Riksbank has fought off SEK strength via FX intervention threats and further monetary policy easing.

Risky assets have supported the cross via the EUR’s status as a preferred funding currency and the SEK’s sensitivity to global risk sentiment.

We reckon, EUR/SEK likely to slump further but has to remain within range bound (above strikes) in next one month or so, eyeing the 1M shorts strangle to expire out of the money. This keeps our long position with the bought 3M EUR/SEK put option within the money maturity.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand