In a widely anticipated move yesterday, Czech President Milos Zeman formally nominated long time ally Jiri Rusnok as CNB governor.

Rusnok has already been a CNB board member and had been Zeman's ally from the early 2000's when he was finance minister in Zeman's government.

Rusnok has made his monetary policy views public in recent months and yesterday reiterated these positions, including emphasis on policy continuity, and no abrupt exit from the EURCZK floor; Rusnok emphasised that it is too early to discuss quitting the FX targeting regime. As a result, we continue to view USDCZK's bear trend continuation, sooner or later it is likely to retest 23.2288 levels.

We reckon that CNB would cut interest rates to negative territory - Rusnok has recently cited the dangers of allowing the spread between CNB and ECB to widen.

Spot ref: 24.2229, we wouldn't be surprised if it shows interim spikes, bears likely to drag again towards 23.2288 levels sooner or later, hence in order to tackle this swing we reckon debit put spreads are best suitable.

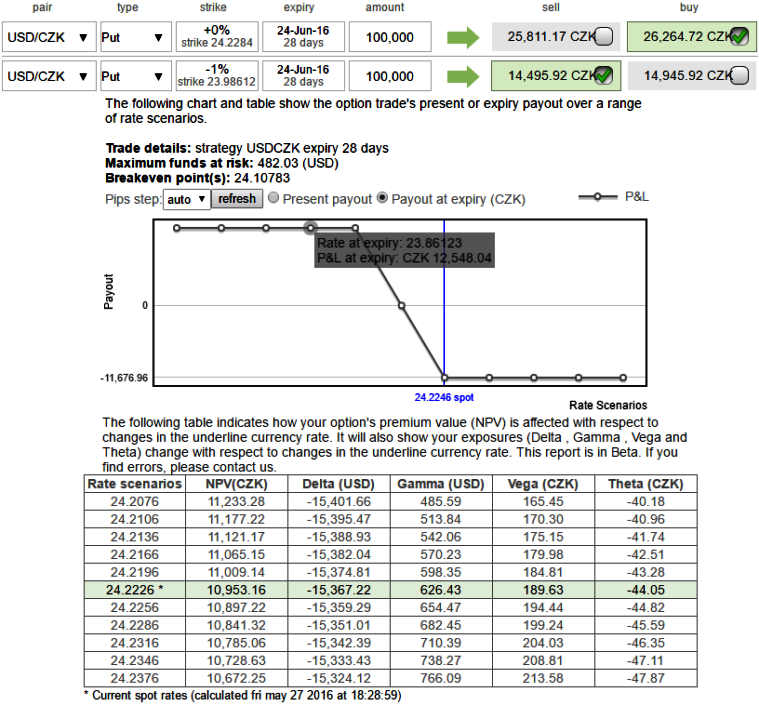

So, here goes the strategy, Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short 1W (1%) OTM Put with lower Strike Price with net delta should be at -0.40.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Please be noted that the tenors used in the diagram are for the demonstration purpose only, use accurate expiries as stated above.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed