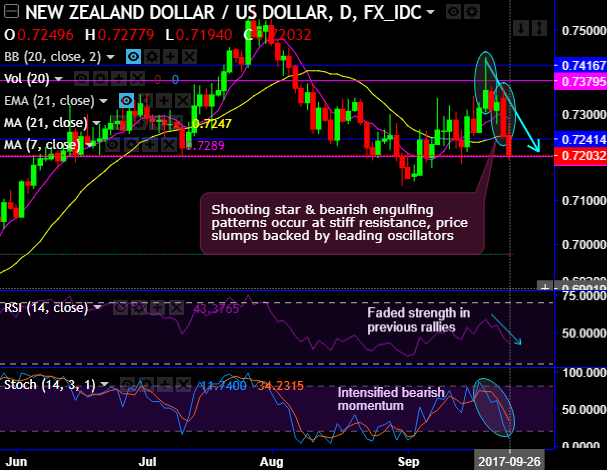

Shooting star & bearish engulfing patterns occur at 0.7355 and 0.7248 levels respectively.

The occurrence of these bearish patterns at stiff resistance zones of 0.7416 – 0.7379 is more noticeable, historically, the rallies have been restrained below these resistance levels.

You could make out that the bears have managed to break below strong support at 0.7244 levels, consequently, we could foresee more slumps upon these flurry of bearish indications (refer daily charts).

Both leading oscillators (RSI and Stochastic curves) have been constantly converging to the ongoing price dips that signal the strength and intensified momentum in the bearish trend.

On a broader perspective, the bulls extend rallies above EMAs in consolidation phase but again restrained below 50% Fibos with an occurrence of bearish engulfing pattern (refer monthly charts).

Well, contemplating above technical rationale in both short and intermediate terms, below trades are recommended:

On intraday speculative grounds, we advocate one touch binary put options to capitalize on prevailing selling sentiments. These leveraged instruments are likely to fetch magnified effects in payoff structure as long as underlying spot FX keeps dipping.

Alternatively, we recommended a limited loss structure via double-no-touch optionality to fade Fed fears of December hikes in next 3-months, NZDUSD 3m DNT with 0.7571/0.6822 strikes – but we are reluctant to sell volatility outright given the unquantifiable risk. However, shorting volatility and fading the spike in skew through limited loss structures (i.e. DNT’s) could be appropriate.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -134 levels (which is highly bearish), while hourly USD spot index was at shy above 105 (highly bullish) at the time of articulating (at 12:40 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand