After Brexit apprehensions, GBPUSD recoupled with short-term rates, which are unlikely to trend in H1’17. The Brexit formalities would not be soft but seems unlikely to bring in large surprises or any dramatic movements in GBP over the next six months. Settling dust and the cable’s future range make GBP volatility a Sell.

Cable neither up nor down: The forecasts suggest the cable in the upcoming months to remain in its new range above 1.20, but not rise as high as 1.30. The UK outlook is definitely too gloomy to turn bullish Sterling and believe in a firm continuation of the ongoing short covering.

On the other hand, a lot of hazardous news is already priced in and digested by the market, preventing it from being overly bearish. Brexit caused two Sterling debacles, first in June with the vote and then after the summer when PM May suggested a hard exit.

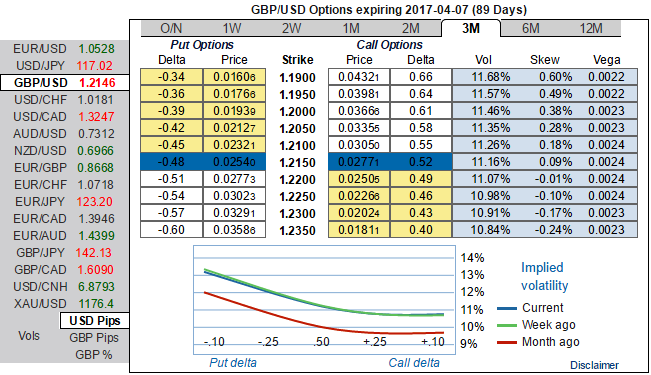

Cable lost about 15% over a quarter and it now seems the dust has settled. In the process, volatility fell but remained relatively high on a historical basis. Assuming a medium-term range in cable and that negative surprises are no longer market tail risks, the GBPUSD volatility is a Sell. While IV skews are still signaling downside risks, 3m positively skewed IVs signifies the hedgers’ interest in bearish risks.

On the slip side, the growing monetary divergence between the Fed and other major central banks further contributed to the rising cost of hedging dollars more recently, with higher short-term rate differentials between USD and EUR/GBP/JPY leading to wider cross-currency bases among major non-dollar currencies since late 2014.

The lingering expectations of further Fed rate hikes this year advocate that cross-currency bases should widen further (become more negative) through H1’17.

Finally, if one compares the cross-currency basis across key G10 currencies since 2008, the impact of idiosyncratic factors becomes obvious.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms