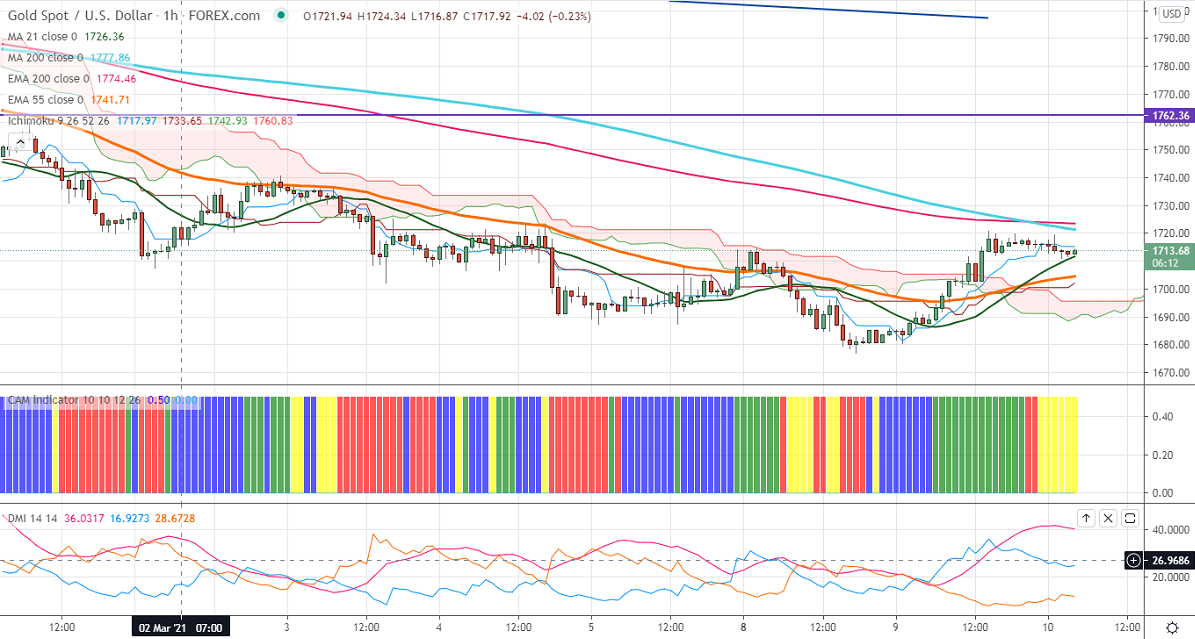

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1715

Kijun-Sen- $1702

Gold recovered more than 2% from a low of $1676 on slight weakness in the US dollar. DXY has formed a minor top around 92.50 and shown a dip till 91.93. Any significant intraday weakness only below 91.60. Markets eye House of Representatives votes on the senate's $1.9 trillion stimulus bill today for further direction. The US 10-year bond yield lost more than 6% on profit-booking also supporting the yellow metal at lower prices.

Economic data-

Major economic data to be watched are the US consumer price index.

Technical:

It is facing strong resistance at $1723 (200- H EMA), violation above targets $1745/$1760. On the lower side, near-term support is around $1700, any indicative break below that level will take the pair to $1675/$1650.

Ichimoku analysis – The yellow metal is holding above Kijun –Sen ($1702). But unable to close above $1715 (Tenken-Sen). Any violation below cloud bottom $1688 will take the gold to next level till $1676.

It is good to buy above $1723 with SL around $1700 for the TP of $1760.