- Gold continuously selling for the past two days after a US fed Powell testimony in Congress. The yellow metal decline was supported by slight jump in US dollar. US dollar has jumped almost 130 pips till 90.74 from the low of 89.50 and is trading at 90.62.

- All the markets will turn their focus to round 2 of fed Chair Powell congressional testimony. The major economic data to be released are US ISM manufacturing and Core PCE index data for further direction.

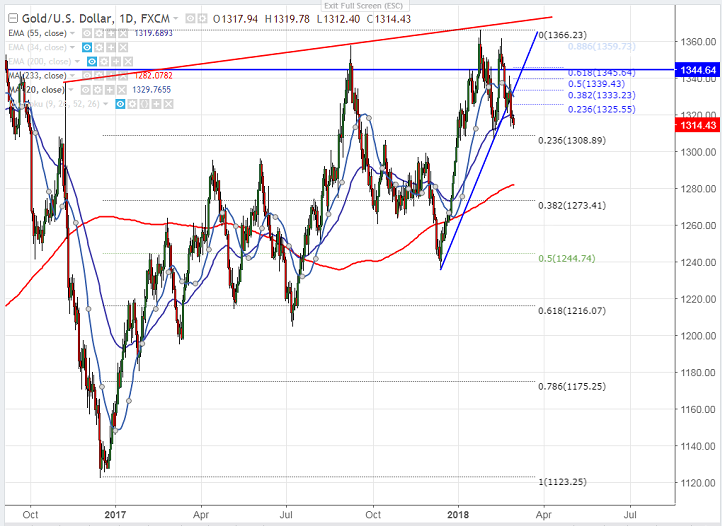

- On the lower side, any break below $1308 (23.6% fib) will drag the gold down till $1305. Bearish continuation only if it breaks below $1305 level. Any violation below $1305 will drag the gold till $1299 (100- day MA)/$1282 (233- day MA).

- The yellow metal broken major resistance at $1325 (23.6% fibo) and any break above will take the yellow metal till $1330/$1342 (50% Fibo)/$1348/$1355. Overall bullish continuation only above $1366.

It is good to sell on rallies around $1323-25 with SL around $1330 for the TP of $1305/$1300.

FxWirePro: Gold trades weak on strong US dollar, good to sell on rallies

Thursday, March 1, 2018 7:13 AM UTC

Editor's Picks

- Market Data

Most Popular

7