FxWirePro: Gold trades lower on strong US bond yields, good to buy on dips

Tuesday, October 17, 2017 5:26 AM UTC

- Gold declined sharply yesterday from the high of $1305.89 on account of slight strength in US dollar and stable US bond yields. The yellow metal prices are supported at lower level due to geo political tensions in North Korea. It is currently trading around $1292.58.

- US President Donald Trump will meet Fed chairman Janet Yellen for selection of new Fed chairman and report shows that he is favoring a policy hawk as next Fed chairman. If next Fed chairman is slightly hawk that will be bullish for U.S dollar.

- US Dollar index has shown a minor recovery after hitting low of 92.75 on Friday. It is currently trading around 93.37. The pair is facing major support near 92.60 and any break below confirms minor weakness till 91.95/91.62. The near term resistance is at 93.36 (55- day EMA) and any break above will take the index to next level till 94.30/95.

- U.S 10 year yield has shown a minor jump after hitting low of 2.27% and it has taken support near 34- day EMA and slight bullishness can be seen above 2.315% (200- day MA).

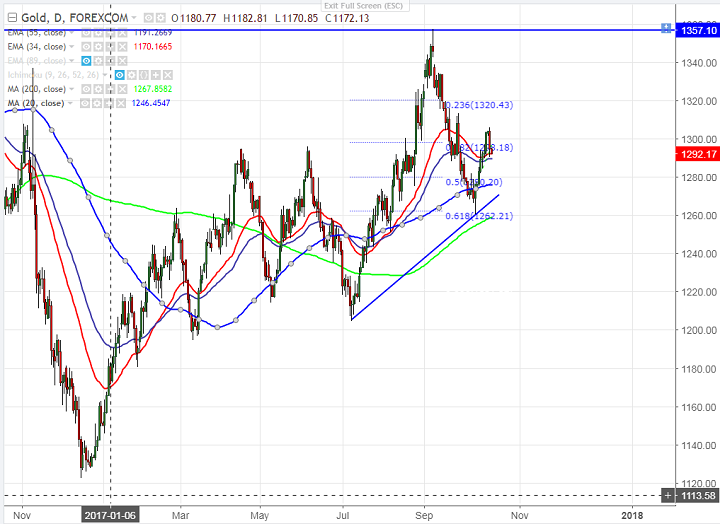

- Technically gold is facing major resistance around $1309 (50% retracement of $1357 and $1260) and any break above will take the yellow metal till $1313/$1320.

- Gold’s near term support is around $1289.76 (55- day EMA) and break below will drag the commodity down till $1286 (20- day MA)/ $1275 (100- day MA)/ $1262 (61.8% retracement of $1204 and $1357.90).The yellow metal should close below $1250 for major trend reversal.

It is good to buy on dips around $1292 with SL around $1286 for the TP of $1309.