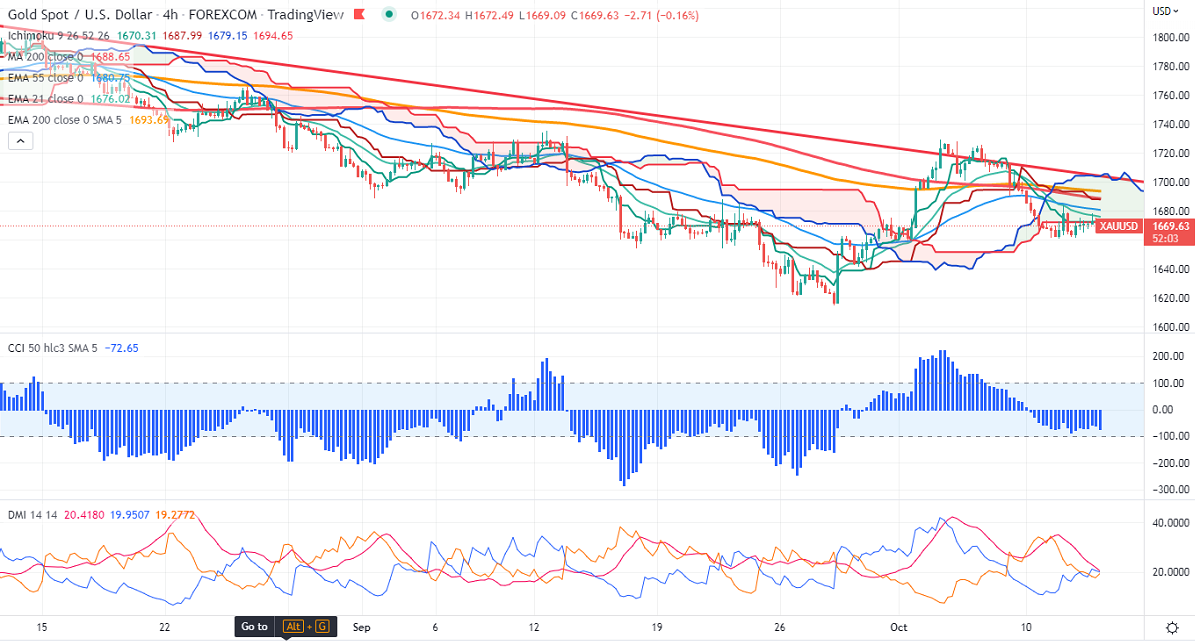

Ichimoku Analysis (4- hour Chart)

Tenken-Sen- $1672.53

Kijun-Sen- $1688.14

Gold is trading lower ahead of US CPI data. The minutes of Sep 20-21 showed that many Fed officials "emphasized the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action." The US dollar index consolidated in a narrow range between 112.41 and 113.59 for the past two days.

The US 10-year yield dropped more than 3.5% after hitting a high of 4%.recovered again towards 4%. The US 10 and 2-year spread narrowed to -35 basis points from -37 bpbs.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Nov rose to 81.4% from 75.2% a week ago.

Economic data to watch today

US CPI 12:30 PM GMT

Factors to watch for gold price action-

Global stock market- bearish (positive for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1660, a close below targets of $1650/$1618.The yellow metal faces minor resistance around $1680, the breach above will take it to the next level of $1700/$1720/$1740/1760/$1800. Minor bullish continuation only if it breaks $1740.

It is good to sell on rallies around $1678-80 with SL around $1700 for TP of $1615.