Gold recovered sharply more than $20 on weak US economic data. US building permits have declined 2-year low and housing starts decreased by 0.9% to a seasonally adjusted annual rate of 1.253 million compared to a forecast of 1.261 million. According to the CME Fed Watch, the probability of 50 bpbs rate cut has increased from 28.7% to 35%.US 10-year yield has lost more than 5% after hitting a high of 2.15%.

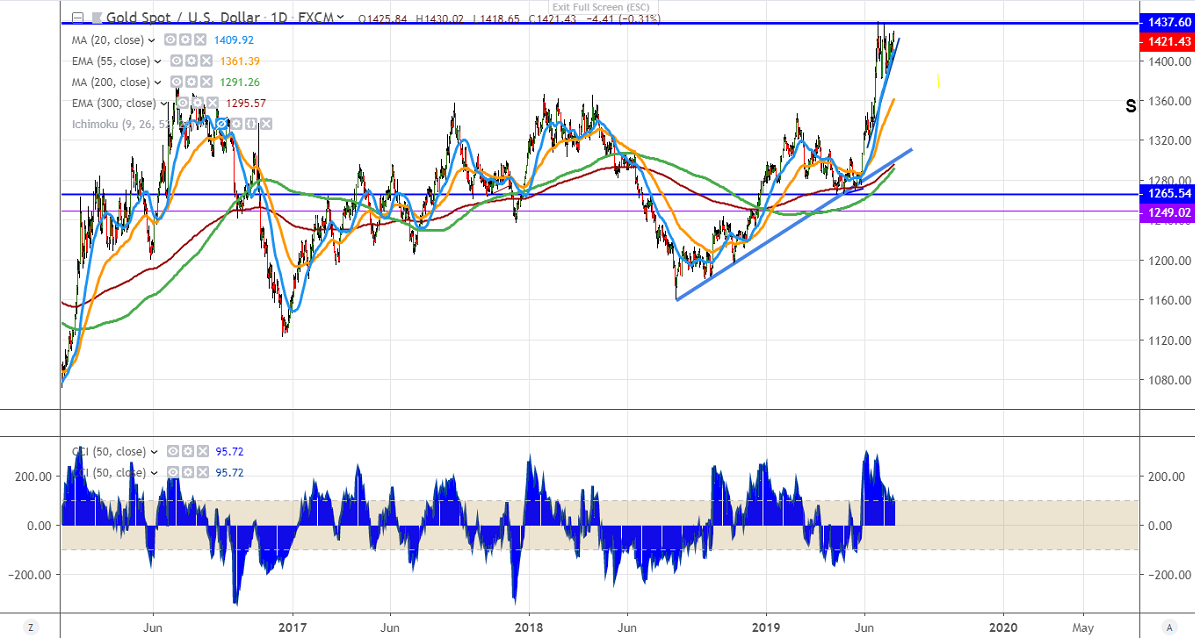

On the flip side, near term support is around $1412 and any break below will drag the yellow metal to the next level till $1400/$1390/$1380. Major weakness only below $1380.

The near term minor resistance is around $1430 and any break above will take the yellow metal to $1440. Any major bullish continuation only above $1440. Any break above targets $1465.

It is good to buy on dips around $1409-10 with SL around $1400 for the TP of $1440.