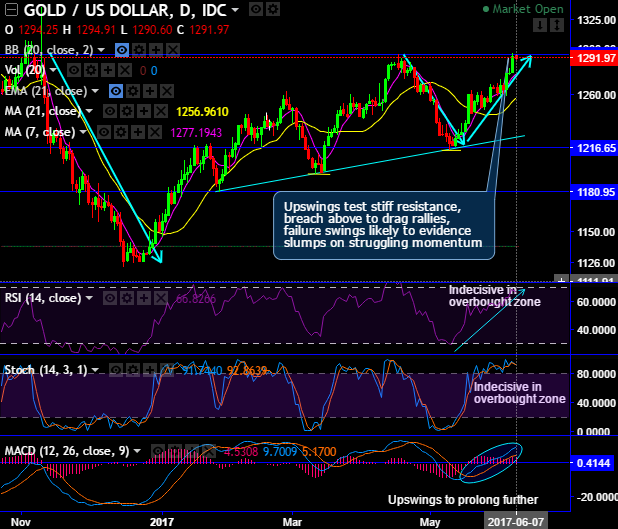

Gold price behavior has been moving in rising trendline with the double bottom formation (refer daily charts).

Bottom 1 at 1195.13, bottom 2 at 1214.40 levels.

The current prices are well above DMAs amid today’s mild downswings for the day, for now, more slumps likely upon breach below strong supports at 1261 and 1250 levels.

RSI and stochastic curves have reached overbought territory but no traces of selling signals even though the struggle for buying momentum is considerable.

While on a broader perspective, the bulls in gold in consolidation phase breach above 23.6% Fib.Ret, 7-EMA cushions to confront interim bears. The breach above 23.6% Fib.Ret after dragonfly doji would likely bring in more bullish sentiments; the prevailing prices going above EMAs in consolidation phase is on conformity, huge volumes are evidenced which is in conformity to this bullish sentiment.

MACD on this timeframe has been a little skeptic about the bullish sentiments that is signaled by the daily charts, this lagging indicator in daily terms signals the upswings in the consolidation phase to extend further with minor hurdles.

Option Strategy: Buy XAUUSD 2w ATM straddle

Please be noted that the OTC markets for this precious metal have been indicating the bullish neutral hedging sentiments, while implied volatilities have been spiking higher ahead of Fed’s hiking hopes.

Although we could see some sort of bullish sensation, the prevailing trend has been range bounded with the major trend goes in the consolidation phase, the recommendation goes this way:

Initiate long in 2w ATM +0.51 delta call, and simultaneously buy ATM -0.49 delta put of the same tenor for a net debit.

Well, this options trading strategy that is used when the options trader ponders that the underlying gold prices would experience significant volatility but not sure of the direction of the swings.