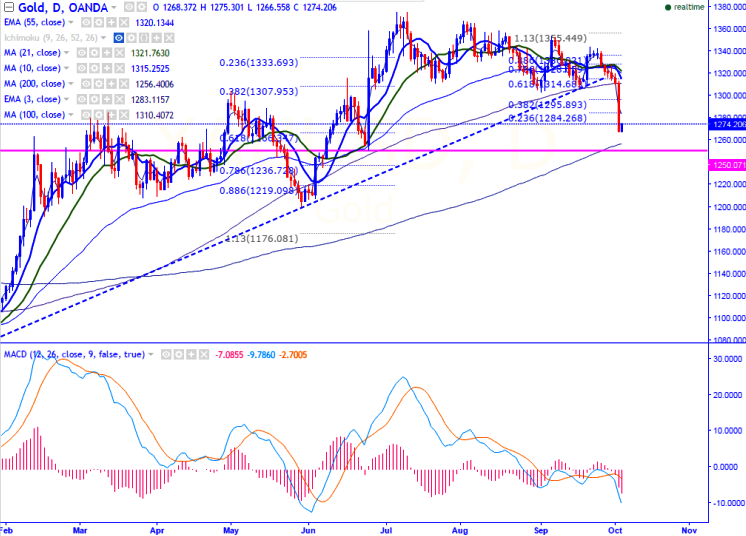

- Major support - $1266 (61.8% retracement of $1199 and $1375.30).

- Gold hits two-week low yesterday on account of the high dollar . It has declined till $1366.90 yesterday and slightly recovered from that level. It is currently trading around $1274.

- The greenback strengthened after the release of U.S ISM manufacturing index data. The index rose to 51.5 last month compared to August’s reading of 49.4.

- Market awaits US Non-Farm-Payroll data on Friday for further direction.

- Technically, any break below 61.8% retracement will drag the gold down till $1255 (200- day MA)/$1225 in the short term.

- On the higher side, resistance is around $1285 (23.6% retracement of $1375.30 and $1266.99) and any violation above targets $1292 (3- day EMA) /$1300. It should close above $1300 for further upside.

It is good to buy on dips around $1265-$1238 with SL around $1250 for the TP of $1285/$1292/$1300