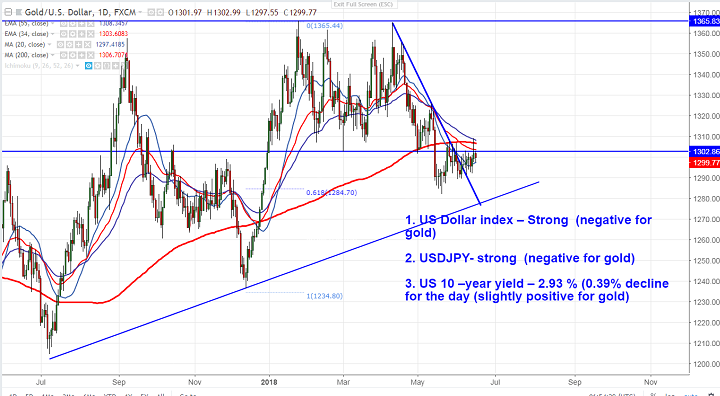

- Gold prices has once again declined after jumping slightly above 200- day MA. US dollar index was trading higher as ECB is planning to keep its rates on hold till summer 2019 and euro plunged to 2- week low. US 2 –year bond yield was trading steady after hitting highest level since 2008 and 10 year yield declined slightly after hitting 3%. USDJPY jumped almost 100 pips from yesterday’s low of 109.91. It is currently trading around 110.84. The yellow metal hits high of $1309.12 yesterday and is currently trading around $1298.

- The major three factors to be watched for gold price movement are

- US Dollar index – Strong (negative for gold)

- USDJPY- strong (negative for gold)

- US 10 –year yield – 2.93 % (0.39% decline for the day (slightly positive for gold)

- The yellow metals near term resistance at $1307 (200- day MA) and any convincing close above will take the yellow metal till $1316 (55- day EMA)/ $1324 (50% fibo).

- On the lower side, near term support is around $1289 and any break below will drag the yellow metal down till $1280/$.

It is good to sell on rallies around $1307-1308 with SL around $1315 for the TP of $1290.