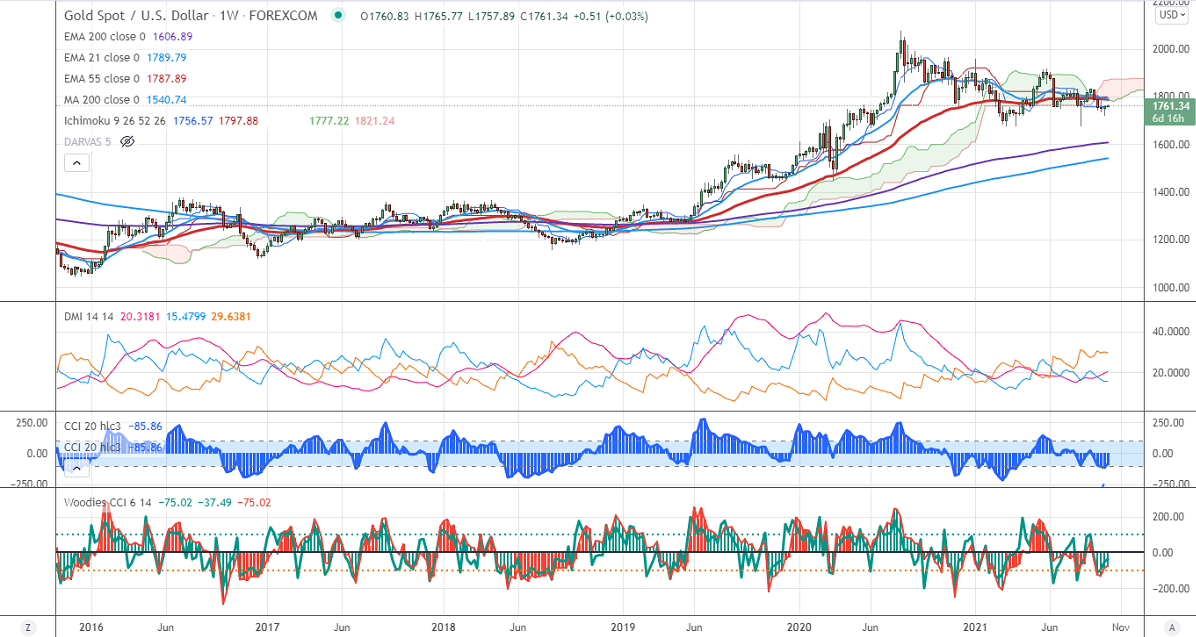

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1756.57

Kijun-Sen- $1797.88

Gold has shown a nice recovery of more than $40 from the previous week's low of $1722 on rising crude oil prices. The risk of inflation fears on jump in energy costs is supporting the yellow metal at lower levels.DXY has started to decline after four weeks of the continuous uptrend. Any breach below 93.69 confirms further bullishness. The yellow metal hits an intraday high of $1765.77 and is currently trading around $1761.45.

Economic data-

. The US economy has expanded at a 6.7% annual pace in the second quarter compared to a forecast of 6.6%. The number of people who have filed for unemployment benefits rose by 11000 last week to 362000 vs. an estimate of 333000. The US conference board consumer confidence declined to 113.80 in August compared to a forecast of 122.90, the lowest level since Feb. the Chicago PMI dropped to 66.8 in August vs. 68 expected.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The immediate resistance is around $1770 and a convincing break above will take the yellow metal $1787/$1800 if possible. It is facing strong support at $1740, violation below targets $1$1725.

It is good to buy on dips around $1750 with SL around $1740 for TP of $1787/$1800.