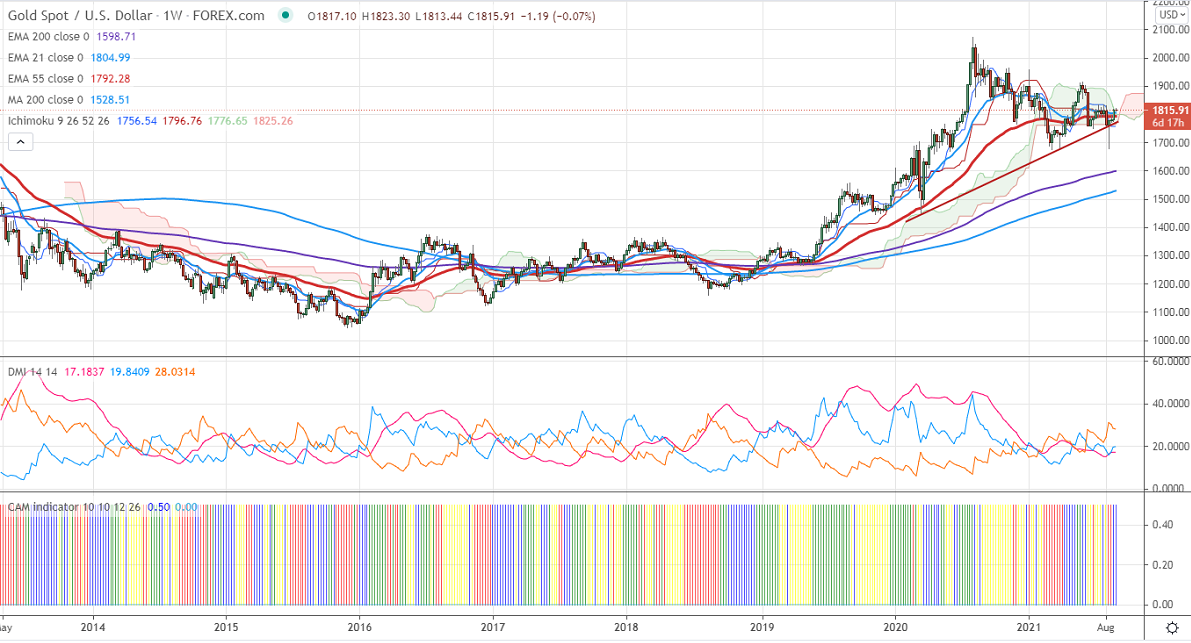

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1756

Kijun-Sen- $1796

Previous week High- $1795

Previous week low- $1770

Gold is trading higher for the second consecutive week on a weak dollar. The US dollar index has lost more than 90 pips from a temporary high of 93.70. The minor decline in yield after US Fed chairman dovish speech also supporting the yellow metal. It is holding well above $1800 and is currently trading around $1816.

Economic data-

He said that the US economy continues to make clear progress towards maximum employment and it would be appropriate to start tapering of bond purchase by year-end. The bank was in no rush to raise interest rates despite a surge in inflation. The US economy grows at a 6.6% annual rate last quarter, slightly better than the previous estimate. The number of people who have filed for unemployment benefits rose by 4000 last week from a revised 349000 previous week.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The immediate resistance is around $1821 and a convincing break above will take the yellow metal $1835/$1850 if possible. It is facing strong support at $1770, violation below targets $1750/ $1730/$1700.

It is good to buy on dips around $1800 with SL around $1790 for TP of $1835.