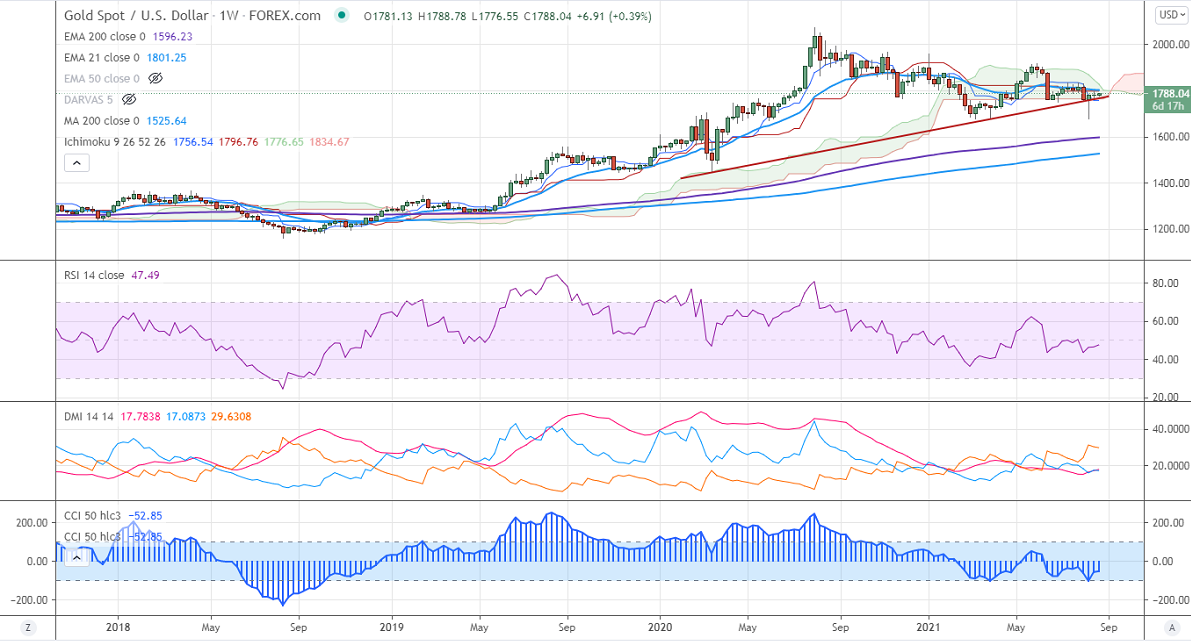

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1756

Kijun-Sen- $1796

Previous week High- $1795

Previous week low- $1770

Gold is trading in a narrow range between $1770 and $1795 in the past week. The surge in the US dollar is putting pressure on yellow metal at higher levels. It is struggling to break above $1800 and is currently trading around $1787.30.

Economic data-

The Fed meeting minutes indicated that the central bank is willing to start tapering of bond-buying by this year's end. The US retail sales have dropped by 1.1% in July compared to a forecast of -0.2%. . The Philly Fed manufacturing index fell to 19.4 compared to a forecast of 23.20, the lowest level since December. The number of people who have filed for unemployment benefits declined by 29000 to 348000, a 17-month low.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The immediate resistance is around $1800 and a convincing break above will take the yellow metal $1835/$1850 is possible. It is facing strong support at $1770, violation below targets $1750/ $1730/$1700.

It is good to buy on dips around $1772-73 with SL around $1760 for TP of $1830.