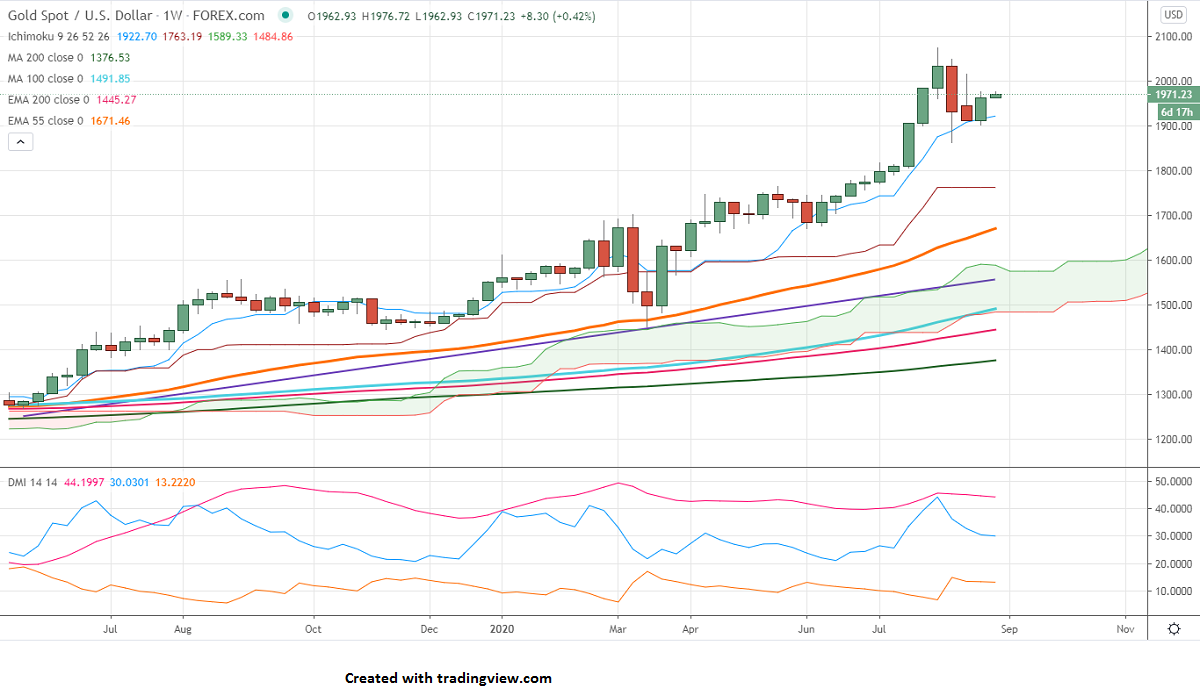

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1916

Kijun-Sen- $1763.90

Gold recovered the previous week after a dovish speech by Fed chairman Powell and an increasing number of coronavirus cases across the world. The number of people who filed for unemployment benefits has risen to 1 million for the week ending Aug22 slightly down from 1.104 million in the previous week. Markets eye US ISM Manufacturing index and Nonfarm payroll data which is to be released this week for further direction. The US 10-year yield declined slightly after hitting a high of 0.785% and real yield is at -1.03% from -0.99% yesterday.

US Dollar Index –Bearish (Positive for yellow metal)

S&P500- Positive (negative for gold)

US Bond yield- positive (negative for gold)

Technical:

The immediate support is around $1900, any indicative break below targets $1862. Major weakness only if it breaks below $1860.The near term resistance is at $1980, the violation above will take to the next level $2000/$2015.

It is good to buy on dips around $1935-40 with SL $1900 for the TP of $2015.