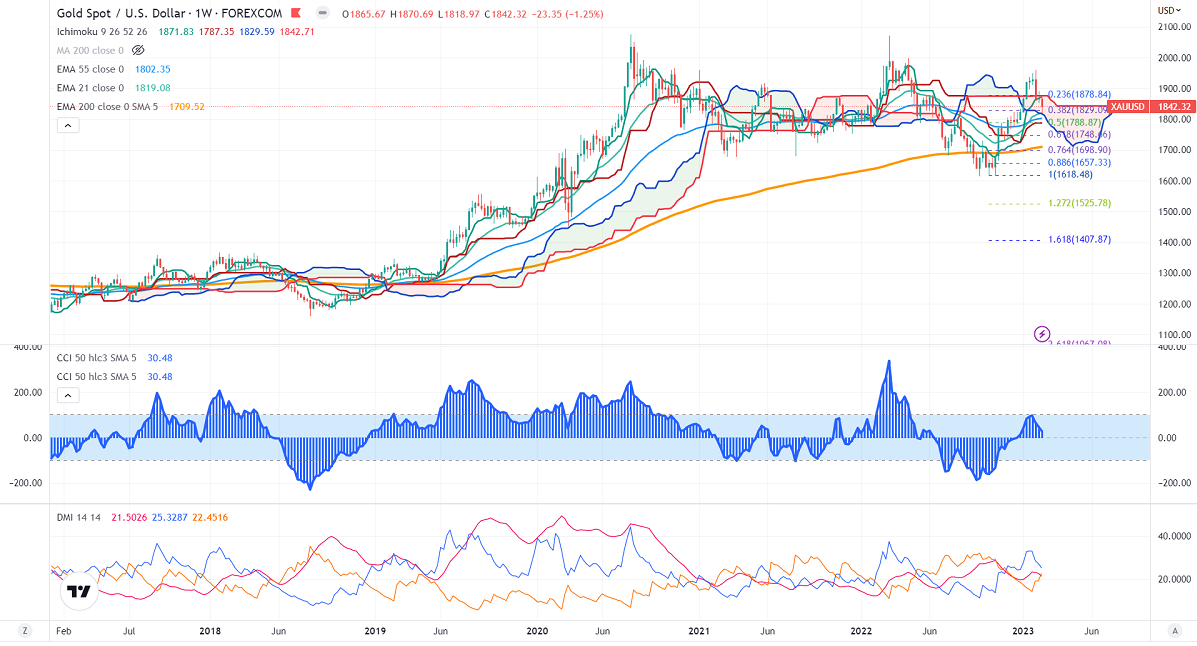

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1866.78

Kijun-Sen- $1787.35

Gold prices showed a minor pullback after three weeks of a consecutive bearish trend. The upbeat US CPI and PPI and hawkish comments from Fed members have increased the chance of a 50 bpbs rate hike by the Fed's next meeting. It hits a fresh February low of $1818 and is currently trading around $1842.32.

The CPI for Jan came at 6.4% YOY, above the estimate of 6.2%. It has declined for the seventh consecutive month after peaking at 9.1% in Jun 2022The producer price index rose to 6% YoY, well above an estimated 5.6%. The inflation for the month of Jan increased by 0.70% monthly basis vs an estimated 0.20%.

US retail sales grew by 3% in Jan monthly, well above expectations of 1.9%. Core retail sales jumped by 2.3%, from -the 09% previous month.

US dollar index-Neutral. Minor support around 102.50/101.50. The near-term resistance is 104.90/106.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Mar jumped to 18.10% from 9.2% a week ago.

The US 10-year yield pared some of its gains made this week ahead of FOMC meeting minutes. The US 10 and 2-year spread narrowed to -80 basis points from -88% bpbs.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Mixed (Neutral for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1816 (21-W EMA), a break below targets of $1800/$1788/$1748. The yellow metal faces minor resistance around $1850, and a breach above will take it to the next level of $1900/$1925/$1950.

It is good to sell on rallies around $1848-51 with SL around $1871 for TP of $1800.