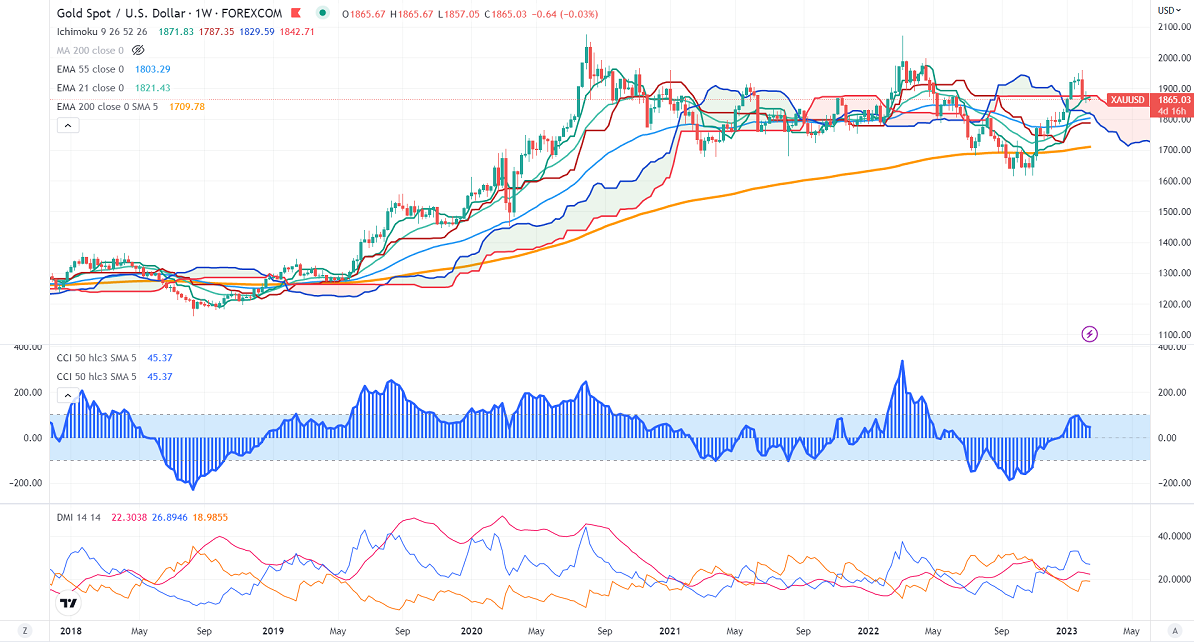

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1866.78

Kijun-Sen- $1787.35

Gold consolidates in a narrow range after a significant sell-off. The yellow metal lost its shine after upbeat US jobs data. The US dollar index holds above 103.50 an elevated hawkish tone by Fed members. It hits a low of $1852.51 and is currently trading around $1861.04.

US dollar index-Bearish. Minor support around 101.50/100.80. The near-term resistance is 104/105.

The number of people who have filed for unemployment benefits rose by 13000 in the previous week to 196000, compared to a forecast of 191000. The university of Michigan sentiment improved to 66.40 in Feb vs 65.0 expected.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb declined to 90.8% from 96.70% a day ago.

The US 10-year yield trades higher for the third consecutive week. Any break and close above 3.69% confirm minor bullishness. The yield spread between 10 and 2-year widened to -82 basis points from -79.40 bpbs.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index –Mixed (Neutral for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1850, a break below targets of $1828/$1800. The yellow metal faces minor resistance around $1880, and a breach above will take it to the next level of $1900/$1925/$1950.

It is good to sell on rallies around $1875 with SL around $1900 for TP of $1800.