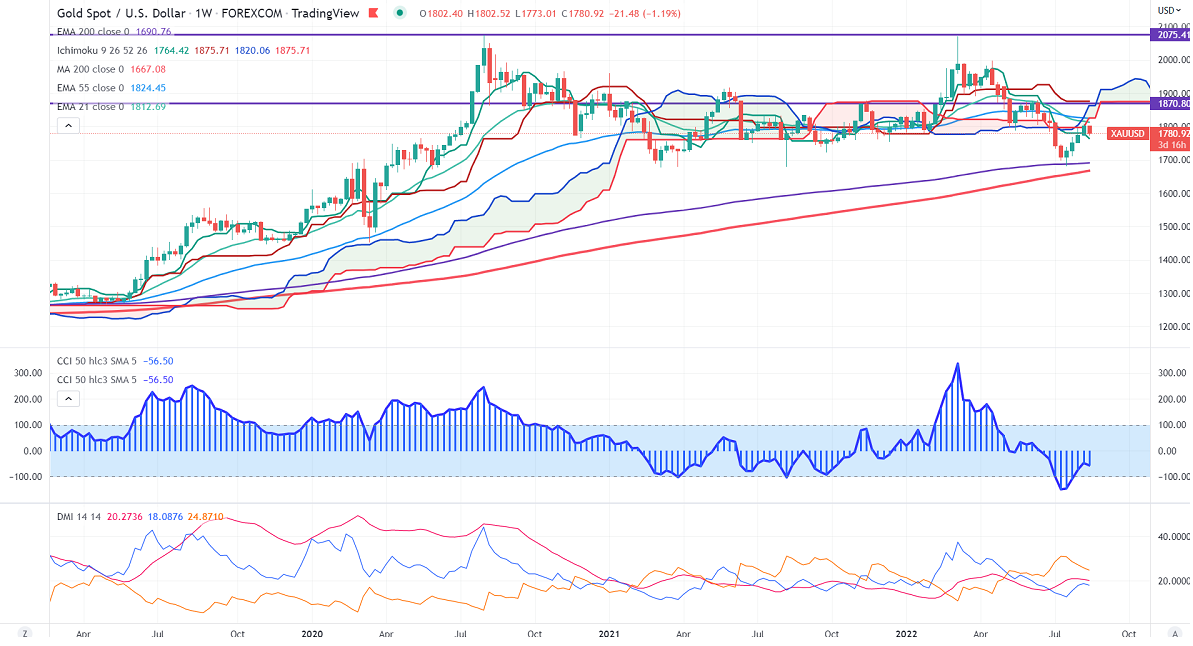

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1780.06

Kijun-Sen- $1875.71

Gold price paired some of its gains on Friday due to the strong US dollar. The yellow metal performed well the previous week on weak market sentiment. The dismal US empire state and weak Chinese data have increased demand for safe-haven assets like Gold.

US dollar index inching towards 107 on recession worries. US empire state manufacturing index slumped to -31.3 in Aug compared to a forecast of 8.5. The inflation slowed from 9.1% YOY to 8.5% YoY, below expectations of 8.7%.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Sep jumped to 61.5% from 32% a week ago.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Mixed (Neutral for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1770, a breach below targets $1760/$1750/$1740. Significant reversal only below $1650. The yellow metal faces minor resistance around $1820, breach above will take it to the next level of $1840/$1860/$1870.

It is good to buy on dips for around $1770 with SL at around $1750 for TP of $1825.