FxWirePro- Gold Daily Outlook

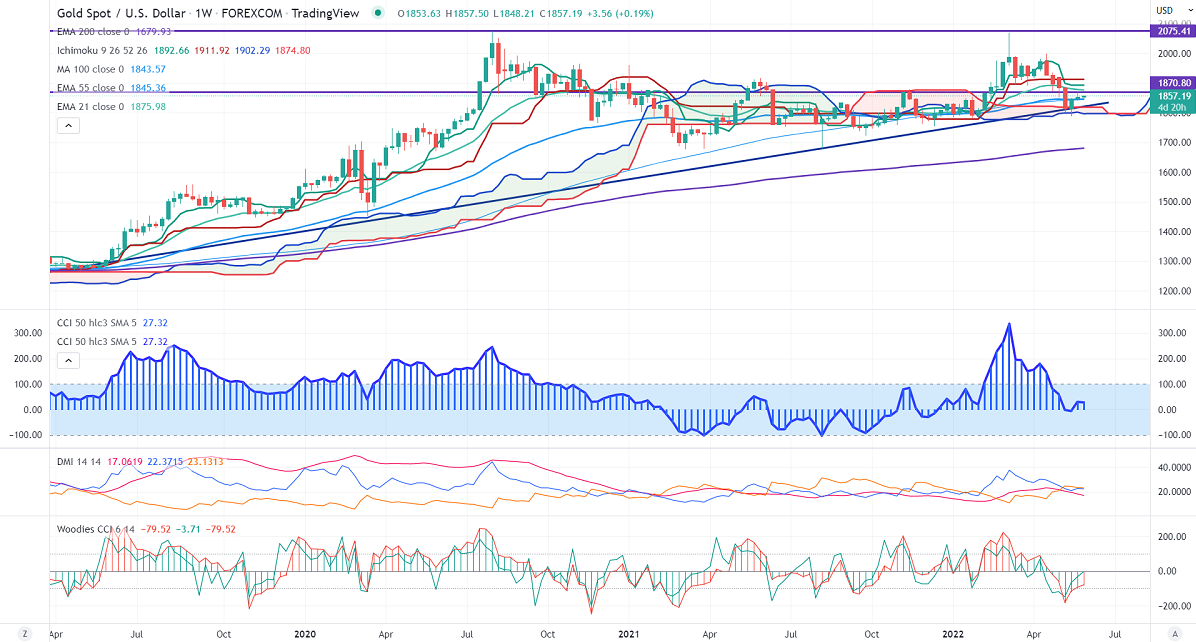

Ichimoku Analysis (Weekly outlook)

Tenken-Sen- $1892.66

Kijun-Sen- $1911.92

Gold holds above $1850 on dismal US economic data. US new home sales declined sharply by 16.6% and pending home sales dropped by 3.9%. US Fed meeting minutes show that there is a 100% probability of a second consecutive 50 bpbs rate hike in Jun. It hits a high of $18 and is currently trading around $1841.61.According to the CME Fed watch tool, the probability of a 50 bpbs rate hike dropped to 93.3% from 97.6% a day ago.

Market eyes US ISM manufacturing PMI and Nonfarm payroll data for further direction.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1830, a breach below targets $1820/$1800/$1750. Significant reversal only below $1750. A dip to $1700/$1689 is possible. The yellow metal faces strong resistance of $1870, any breach above will take to the next level $1880/$1900/$1920.

It is good to buy on dips around $1828-30 with SL around $1800 for TP of $1920.