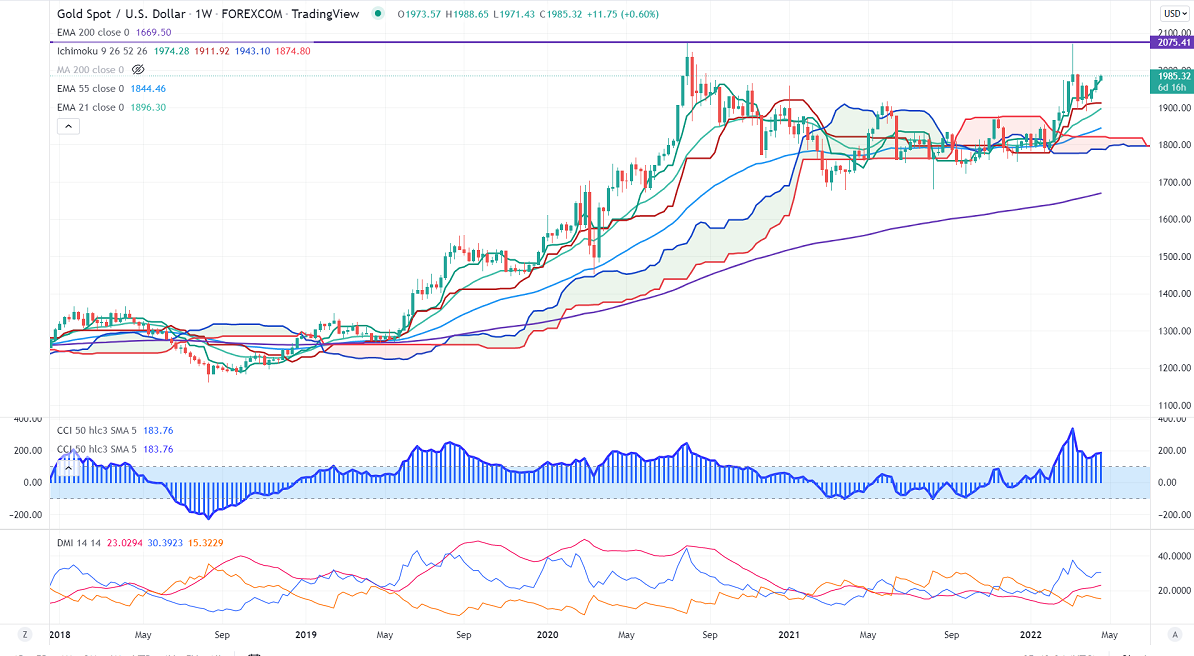

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1957

Kijun-Sen- $1911.92

Gold hits five-week highs on increase in safe-haven demand. The surge in inflation and Russia and Ukraine war tensions support the yellow metal at lower levels. The major obstacle for the yellow metal to breach the $2000 level is the strong US dollar. DXY trades higher for a third consecutive week and holds well above the 100 level. The yellow metal hits an intraday high of $1988.65 and is currently trading around $1986.14.

The number of people who have filed for unemployment benefits declined to 166000 last week vs. an estimate of 201K. The inflation jumped to a four-decade high of 8.5% in March compared to a forecast of 8.4%. While core CPI came at 6.5% vs. an estimate of 6.7%.

Factors to watch for gold price action-

Global stock market- Flat (Neutral for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1974, violation below targets $1960/$1950/1940. Significant reversal only below $1890. A dip to $1850/$1800 is possible. The yellow metal faces strong resistance of $2000, any breach above will take to the next level $2020/$2050.

It is good to buy on dips around $1970-71 with SL around $1950 for TP of $2020/$2050.