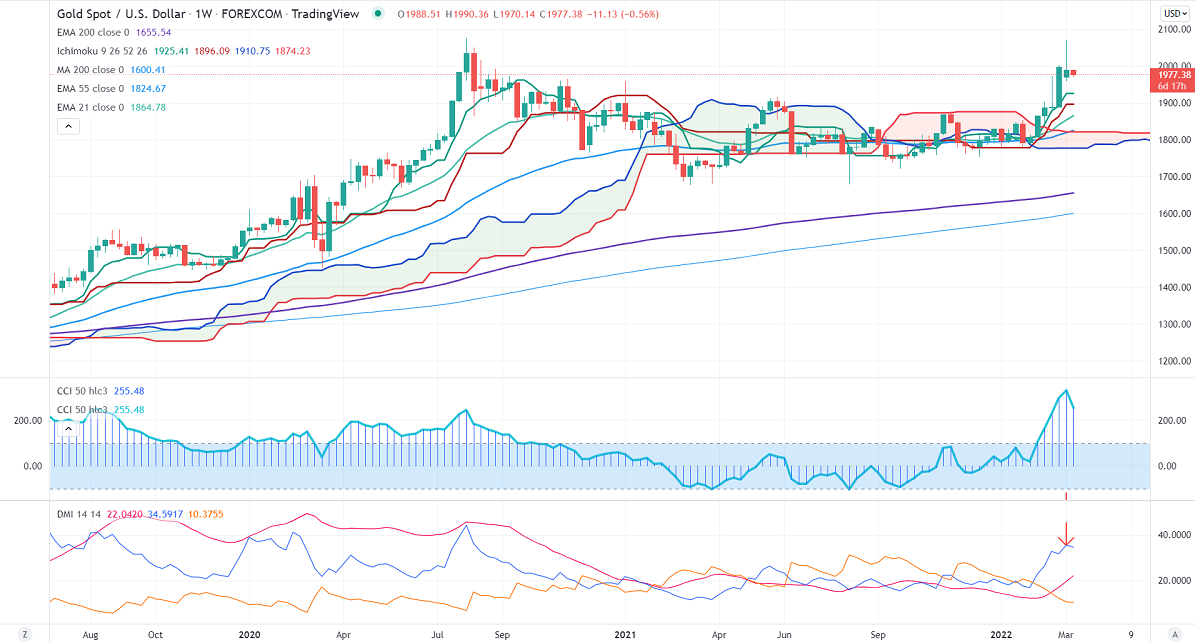

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1925

Kijun-Sen- $1896

Gold continues to trade lower on de-escalation of tension between Russia and Ukraine. Markets await Fed monetary policy this week for further direction. Any 50 basis point rate hike will pull yellow metal don below $1900. Gold hits a low of $1958.75 and is currently trading around $1975.70. The gold downside is capped due to

The progress of peace talks about peace talks between the two countries.

China's COVID threat.

Economic data-

US CPI came at 7.9% y/y vs 7.9% expected. The number of people who have filed for unemployment benefits jumped by 11000 to 227000 in the week ended Feb compared to a forecast of 220000.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1960, violation below targets $1925/$1900. Significant reversal only below $1875.The yellow metal faces strong resistance of $2020, any violation above will take to the next level $2050/$2075.

It is good to sell on rallies around $2020 with SL around $2050 for TP of $1900.