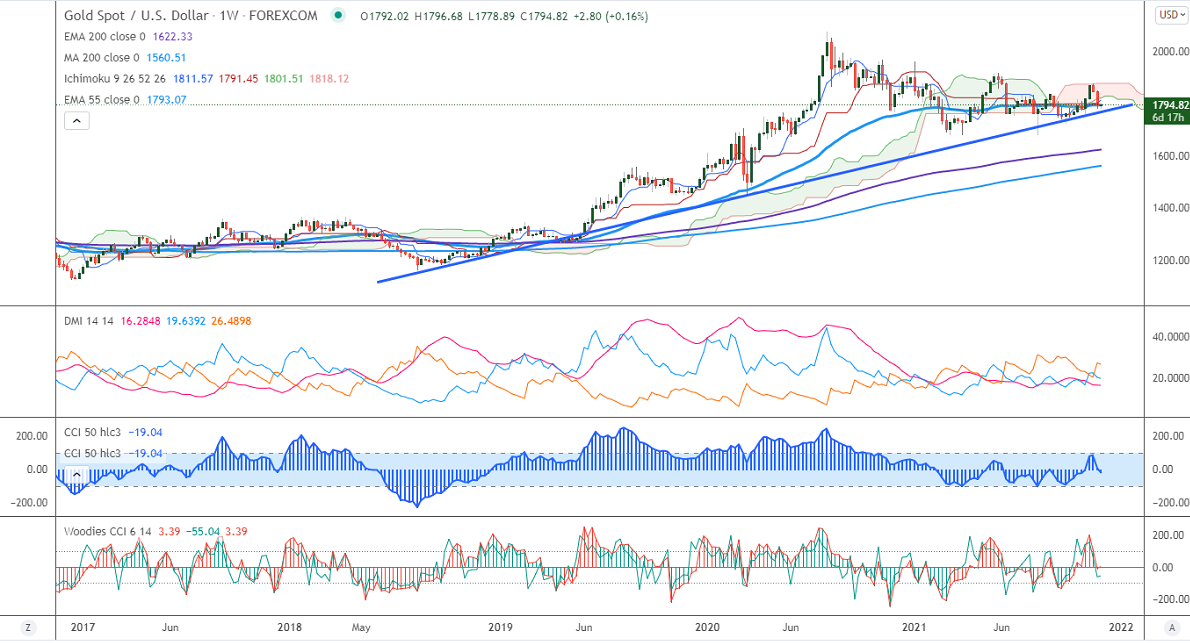

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1799.44

Kijun-Sen- $1797.88

Gold recovered more than $30 from a multi-week low of $1778 as investors got panic due to the new coronavirus Omicron. The demand for safe-haven assets like yen, gold has increased as the chance of reinfection is higher. The US 10-year yield tanked nearly 10% on concerns of the new variant. The minor pullback in the US dollar index is putting pressure on the yellow metal at higher levels. It hits a high of $1815.59 and is currently trading around $1793.35.

Economic Data-

US personal income jumped to 0.50% and the headline PCE surged 5.0% YOY above expectations of 4.6%. US real GDP came at 2.1% in Q3 at annualized rate vs. an estimate of 2.2%. The number of people who have filed for unemployment benefits for the week ended dropped by 71000 to 199000, the lowest level since mid-November.

Factors to watch for gold price action-

Global stock market- Bearish (Negative for gold)

US dollar index –Bearish (Positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

It faces strong support at $1778, violation below targets $1760/$1740/$1700.Significant trend continuation only below $1675. The yellow metal facing strong resistance $1815, any breach above will take to the next level $1835/$1860/$1900 is possible.

It is good to buy on dips around $1782-83 with SL around $1770 for TP of $1835.