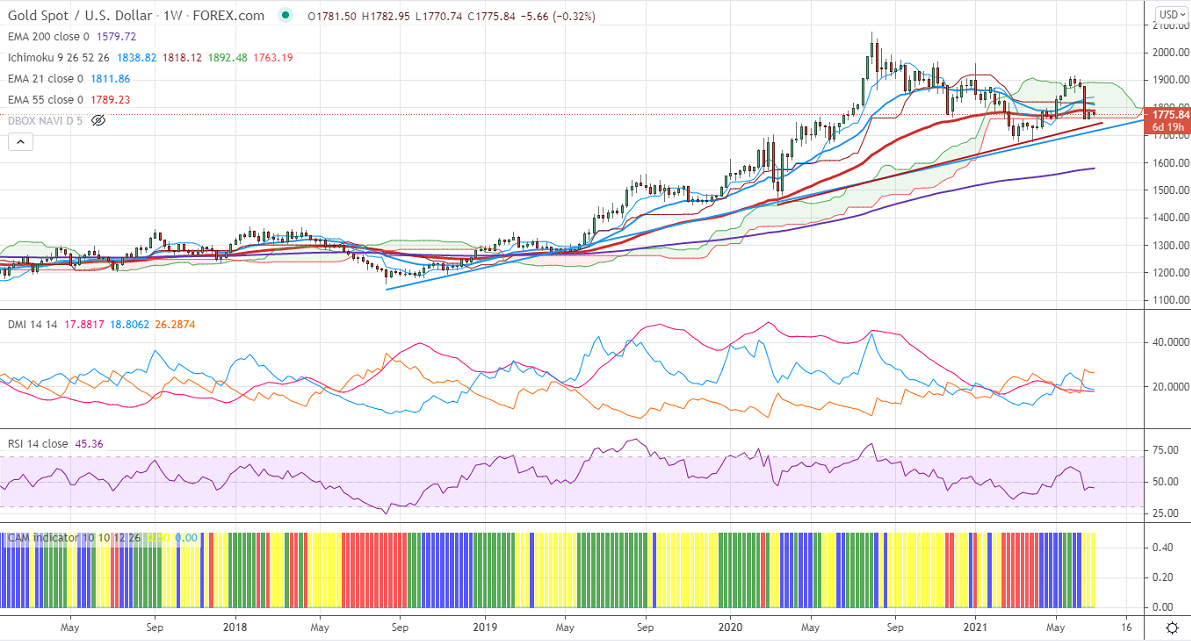

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1836

Kijun-Sen- $1818

Gold is consolidating for the past one week after a massive sell-off. The yellow metal has advanced to $1789 after upbeat US PCE data. But it has pared most of its gains on the strong US dollar. It has taken support near 200- H MA and shown a minor pullback. It should close above92 levels for further up move. The US bond yields gained more than 14% from a minor bottom 1.354%. Gold hits an intraday low of $1770 and is currently trading around $1774.

Economic data:

US core Personal consumption expenditure surged to 3.1% y/y v.s forecast of 2.9%. The monthly core Personal consumption came at 0.7%, above the estimate of 0.6%. US Markit flash manufacturing PMI surged to a record high in June. The number of people who have filed for unemployment benefits has decreased by 7000 to 411000 in the week ended Jun 19th.

Technical:

It is facing strong support at $1760, violation below targets $1740/$1720/$1700. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1800, any convincing break above will take the yellow metal to $1825/$1836/$1860 is possible.

It is good to sell on rallies around $1800-01 with SL around $1825 for the TP of $1700.