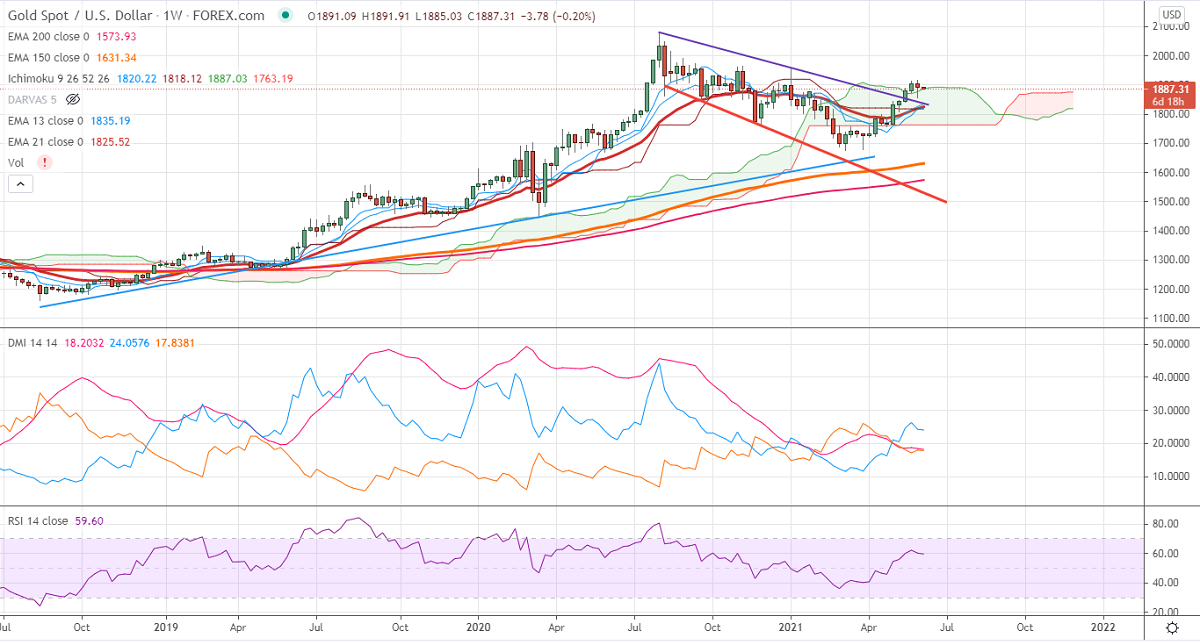

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1818.92

Kijun-Sen- $1818.12

Gold recovered sharply after hitting a low of $1855 the previous week after dismal US jobs data. The minor weakness in US bond yield is supporting the yellow metal at lower levels. The US 10-year bond yield lost more than 5% from minor top 1.635%. The dollar index is holding below 90 levels, a dip till 89.20. Gold hits a high of $1916 and is currently trading around $1887.22.

Economic data:

The US ADP data shows that the economy has added 978000 jobs in May vs a forecast of 650K. The unemployment declined to 5.8% vs 6.1% in April. The US Nonfarm payrolls came slightly weaker than expected in May at 559K compared to an estimated 675K. The ISM indexes of manufacturing and services jumped sharply in May, but supply shortage is the cause of concern.

Technical:

It is facing strong support at $1880, violation below targets $1870/$1860/$1840/$1820. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1912, any convincing break above confirms bullish continuation. A jump to $1932/$1950 is possible.

It is good to buy on dips around $1860 with SL around $1845 for the TP of $1900.