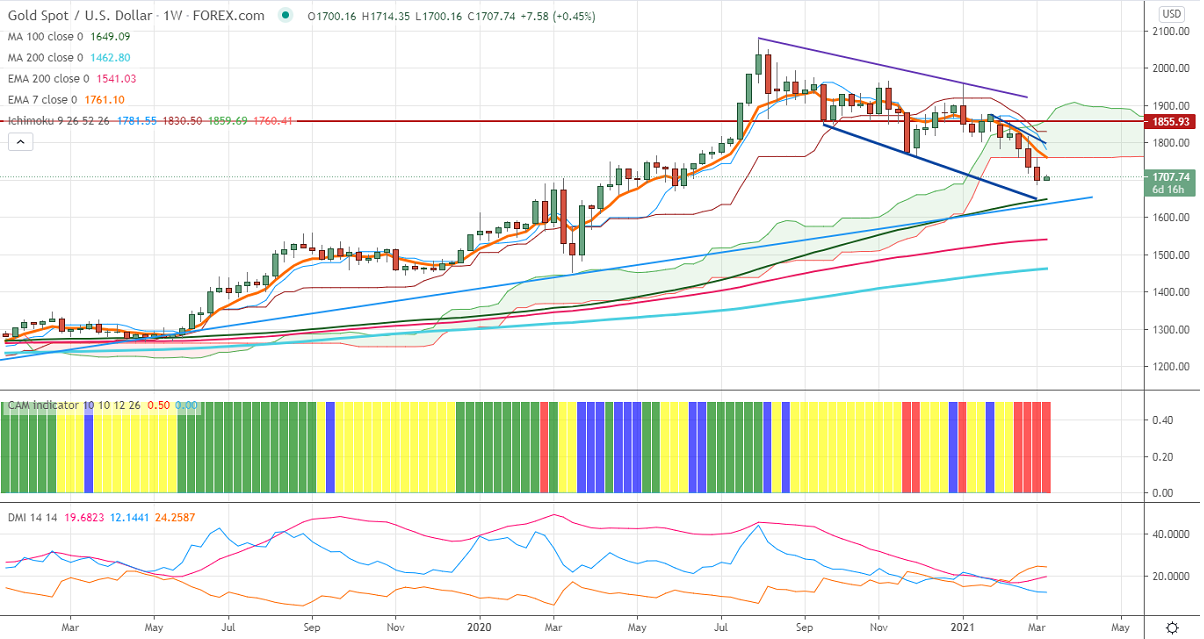

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1838

Kijun-Sen- $1830

Gold has shown a minor recovery of more than $15 after a major sell-off in the past three weeks. The slight decline in the US 10-year yield from the temporary top is supporting the yellow metal at lower levels. US dollar index continues to trade higher and holding above 92 levels. Any violation above 92.20 confirms bullish continuation.

Economic data:

US ISM manufacturing index came at 60.8% in Feb up by 2.1 percentage points from Jan 58.7%, slightly better than the forecast of 58.7%. The number of private jobs added by 117000 in Feb compared to a forecast of 203k. The US ISM services came at 55.3 in Feb vs an estimate of 58.70. The US economy has added 379k in Feb much above expectations of 148k. The unemployment rate declined to 6.2% vs an estimate of 6.3%. Average hourly earnings came in line with an estimate at 0.2%.

Technical:

It is facing strong support at $1685, violation below targets $1660/$1637. On the higher side, near-term resistance is around $1715 (100- H MA), any indicative break above that level will take till $1735/$1744/$1760.

It is good to sell on rallies around $1728-30 with SL around $1760 for the TP of $1650.