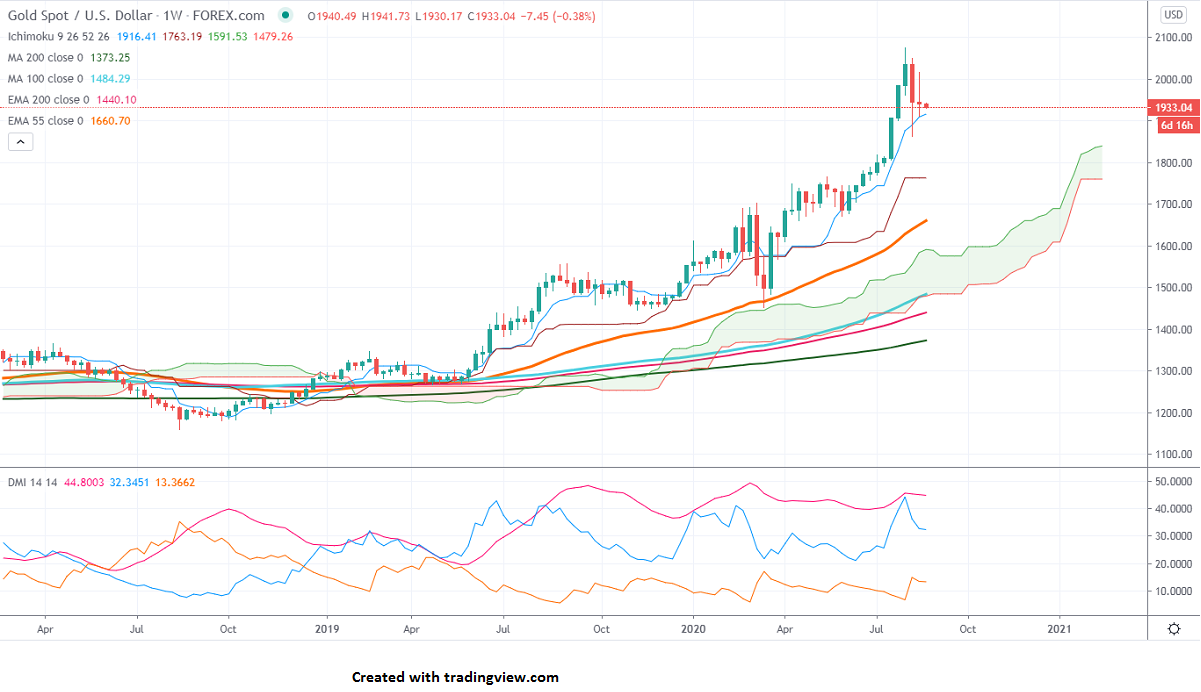

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1908

Kijun-Sen- $1763

Gold continues to trade lower for 2nd consecutive week on the strong dollar. The yellow metal declined after COVID 19 treatment optimism. The USA drug regulator has authorized the use of blood plasma recovered from Corona. But US-China trade tension and delay in US stimulus package is supporting bulls at lower levels. US dollar index recovered more than 100 pips from the bottom 92.13. The US 10-year yield is trading weak and real yield is at -1.00% from -0.97% yesterday.

US Dollar Index – Slightly Bullish (negative for yellow metal)

S&P500- Positive (negative for gold)

US Bond yield- slightly negative (positive for gold)

Technical:

The immediate support is around $1900, any indicative break below targets $1862. Major weakness only if it breaks below $1860.The near term resistance is at $1970, the violation above will take to the next level $2000/$2015.

It is good to sell on rallies around $1958-60 with SL $1975 for the TP of $1907.