Gold lost more than $30 on surge in US treasury yields. The 10-year yield jumped more than 8% and hit a five-week high as the latest omicron virus will do less harm to the economy. The hopes of a rate hike by the Fed also dragging yellow metal. It hits a low of $1798 and is currently trading around $1803.75.

Factors to watch for gold price action-

Global stock market- Bullish (Negative for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (Negative for gold)

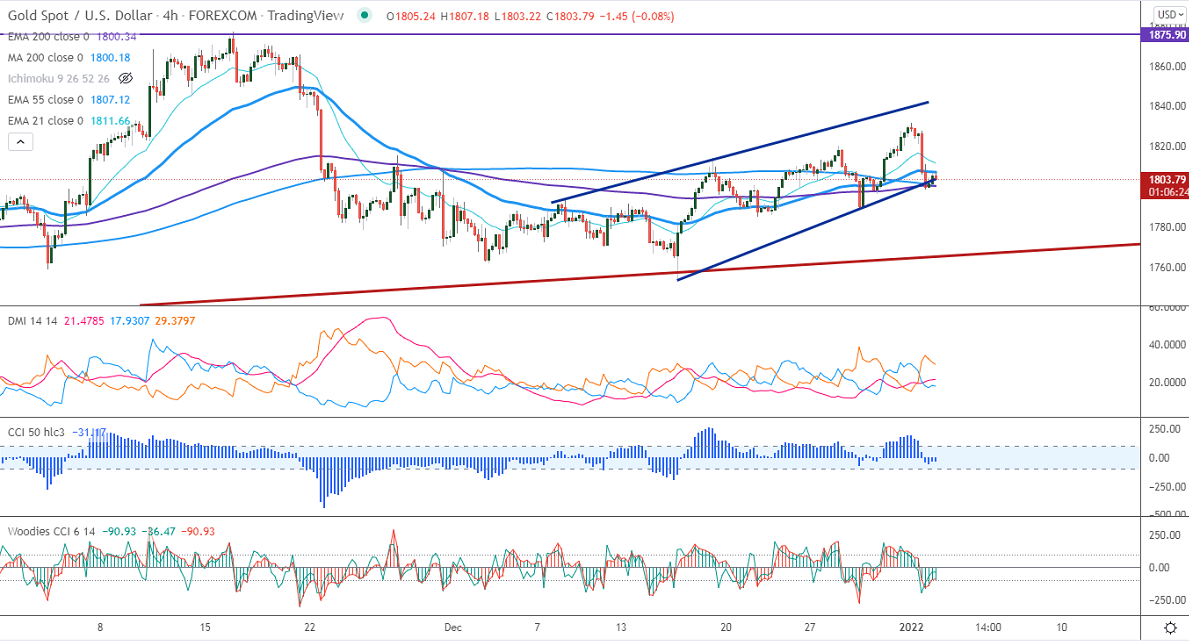

Technical:

The near–term major support is around $1790, violation below targets $1790/$1780/$1770.Significant trend reversal only below $1750.The yellow metal facing strong resistance $1815, any violation above will take to the next level $1835/$1860/$1877$1912 is possible.

It is good to sell on rallies around $1815-16 with SL around $1832 for TP of $1760.