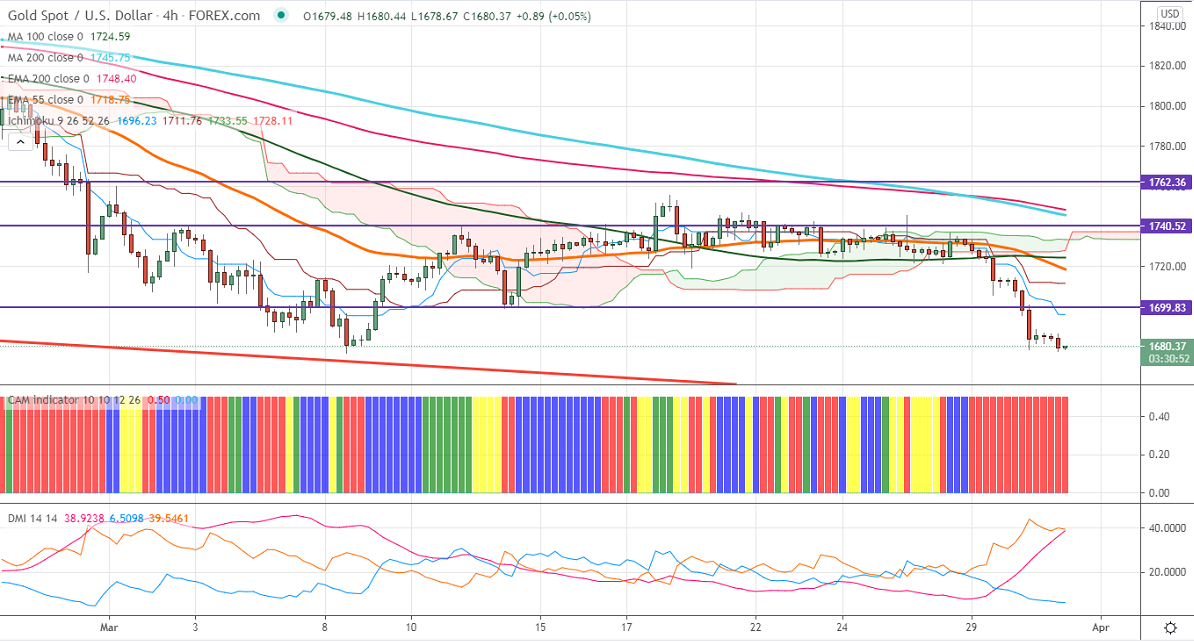

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1702

Kijun-Sen- $1712

Gold is trading extremely weak and lost more than $35 on strong US dollar and surging US bond yield. US dollar index is trading higher and hits the highest level since November 2020. A strong close above 200-day EMA confirms trend continuation; a jump till 94.30 is possible. The US 10-year bond yield jumped more than 10% from a low of 1.59% made on Mar 24th, 2021. The yellow metal hits an intraday low of $1677 and is currently trading around $1680.

Economic data:

Markets eye US ADP employment and pending home sales data for further direction. The Conference Board Consumer confidence came at 109.70 in Mar, the highest level in one year.

Technical:

It is facing strong support at $1675, violation below targets $1650/$1625. On the higher side, near-term resistance is around $1700, any indicative break above that level will take till $1725/$1745/$1760.

It is good to sell on rallies around $1689-90 with SL around $1700 for the TP of $1650.