FxWirePro: Gold Daily outlook

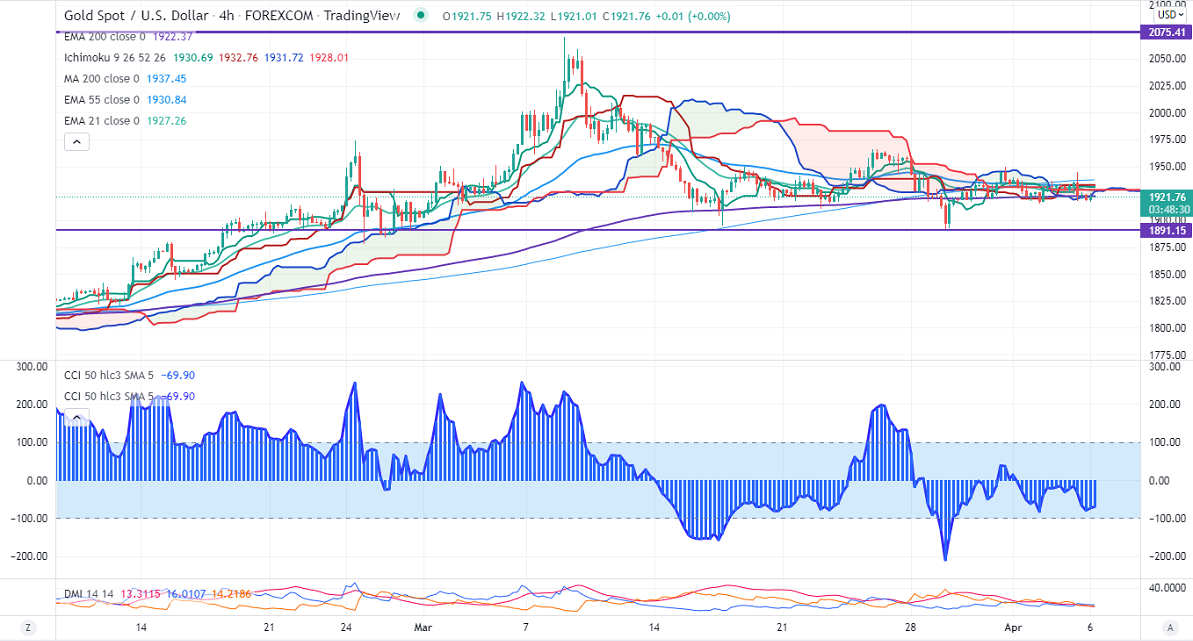

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1930.89

Kijun-Sen- $1932.76

Gold has lost its shine after the FOMC member speech. Hawkish comments from Fed Governor Lael Brainard and San Francisco Fed President Mary Daly have dragged the yellow metal by more than $20.Markets eye US Fed meeting minutes for further direction. US 10- year yield hits year high in hopes of an aggressive rate hike. The yellow metal hits an intraday low of $1920.57 and is currently trading around $1921.08.

US ISM services PMI increased to 58.3 in Mar vs 58.40.

Factors to watch for gold price action-

Global stock market- Flat (Neutral for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1915, violation below targets $1910/$1895/$1877/$1850/$1800. Significant reversal only below $1750.The yellow metal faces strong resistance of $1950, any breach above will take to the next level $1960/$1977/$2000/$2020.

It is good to sell on rallies around $1928-30 with SL around $1950 for TP of $1850.