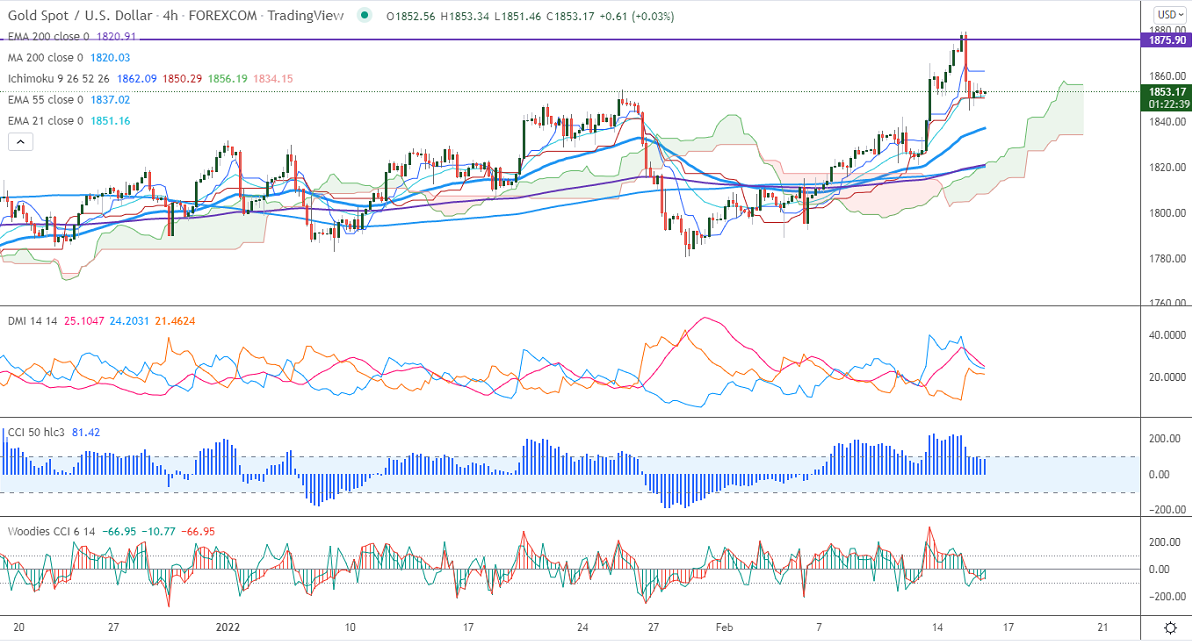

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1862.09

Kijun-Sen- $1850.29

Gold lost more than $30 after Russia and Ukraine's tension de-escalated. The demand for riskier assets surged after Russia informed that some troops had withdrawn from the Ukraine border. Headline US PPI for Jan accelerated to 9.7 YoY vs 9.1 expected. Gold hits a low of $1844 and is currently trading around $1852.85.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1840, violation below targets $1830/$1818. Significant reversal only below $1750.The yellow metal faces strong resistance of $1880, any violation above will take to the next level $1900/$1912/1925 is possible.

It is good to buy on dips for $1840 with SL around $1820 for TP of $1900.