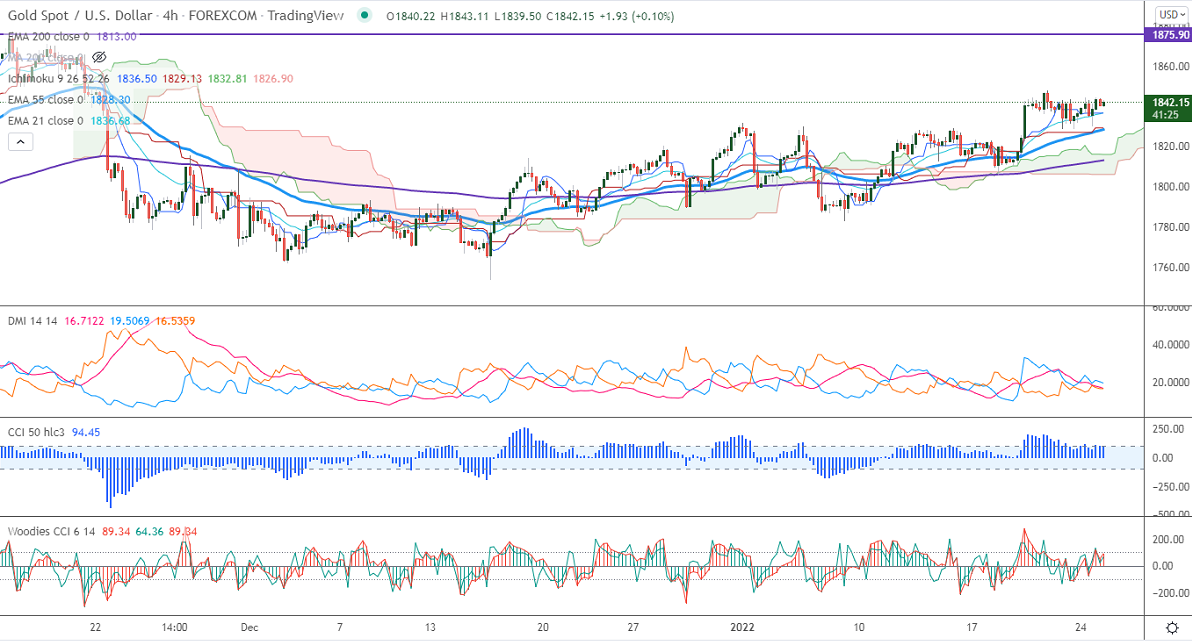

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1836.50

Kijun-Sen- $1829.13

Gold recovered from yesterday's low of $1829.78 on safe-haven demand. Global stock markets crashed heavily on geopolitical uncertainties as tensions mounted between Russia and Ukraine. Markets eye US Fed monetary policy meeting on the further direction. The US dollar index showed a nice pullback after hitting a low of 94.63. Gold hits an intraday high of $1843.69 and is currently trading around $1842.32.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1825, violation below targets $1810/$1800/$1770/$1750. Significant reversal only below $1750.The yellow metal facing strong resistance $1815, any violation above will take to the next level $1835/$1860/$1877$1912 is possible.

It is good to buy on dips around $1825-26 with SL around $1810 for TP of $1880.