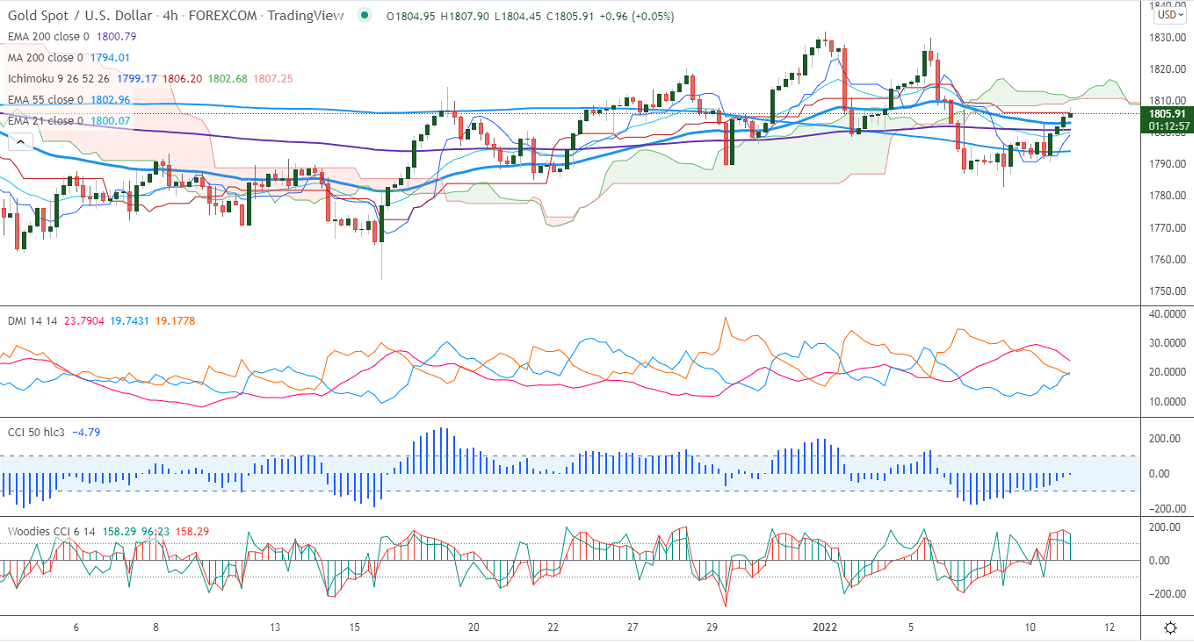

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1796.31

Kijun-Sen- $1806.20

Gold regained above the $1800 level on the weak US dollar. Markets eye US Fed chairman testimony for further direction. The US dollar index is holding below 96 levels despite hawkish Fed and surging yields. The minor sell-off in US treasury yield supports the yellow metal at lower levels. Gold hits an intraday high of $1807 and is currently trading around $1805.89.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index –Bearish (negative for gold)

US10-year bond yield- Bullish (Negative for gold)

Technical:

The near–term support is around $1780, violation below targets $1770/$1750. Significant reversal only below $1750.The yellow metal facing strong resistance $1815, any violation above will take to the next level $1835/$1860/$1877$1912 is possible.

It is good to sell on rallies around $1815-16 with SL around $1832 for TP of $1760.