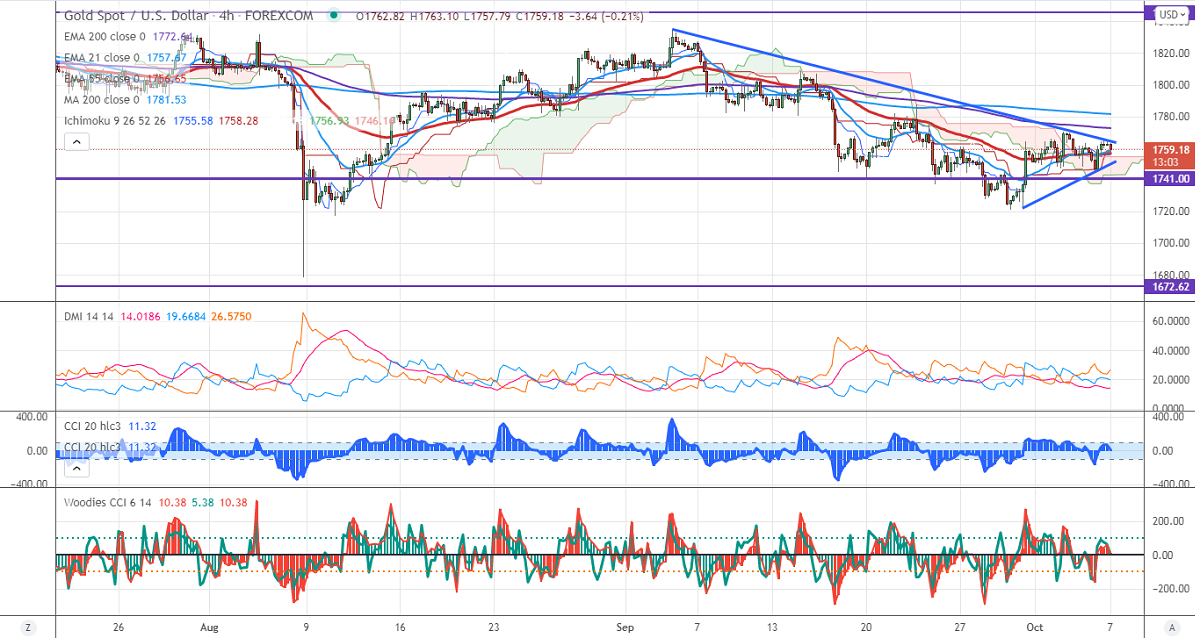

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1755.58

Kijun-Sen- $1758.58

Gold has shown a minor pullback after hitting a low of $1745.The minor weakness in the US dollar and US treasury is supporting the yellow metal. The US dollar index has once again declined after hitting a high of 94.44. Any surge past 94.50 confirms a bullish continuation. The stronger ADP jobs data has increased hopes of tapering by the Fed. The overall trend is still on the downside as long as resistance $1835 holds.

Economic Data-

US ADP private payrolls increased by 568000 in September much above expectations of 475000.

The factors dragging the gold prices are

USDJPY-

The yen and gold are 90% positively correlated to each other. USDJPY is holding above 111 on board-based US dollar buying.

Technical:

The immediate resistance is around $1770 and a convincing break above will take the yellow metal to $1787/$1800. It is facing strong support at $1750, violation below targets $1740/$1720.

It is good to sell on rallies around $1770-71 with SL around $1787 for TP of $1675.