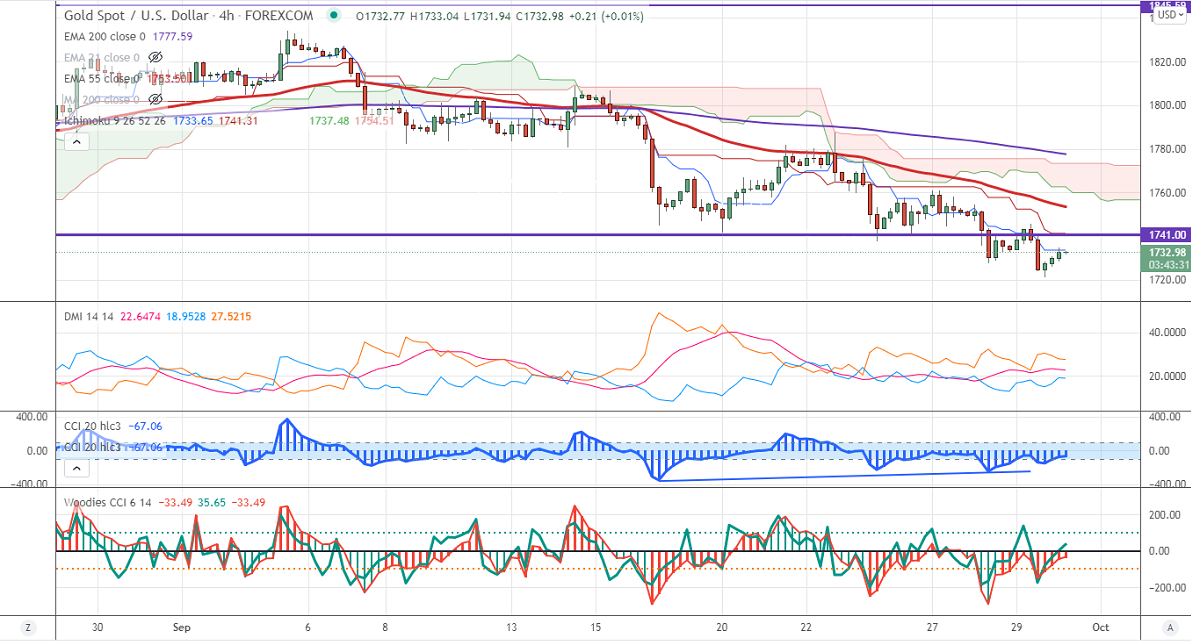

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1733

Kijun-Sen- $1741

Gold has shown a massive sell-off till $1721 on a strong dollar and surging US Treasury yields. US Fed chairman's speech yesterday confirms that the central bank to taper pandemic-related QE program as soon as possible. US dollar index gained strength on tapering hopes and hits fresh yearly high. The overall trend is still on the downside as long as resistance $1835 holds. Markets eye US GDP and initial jobless claims for further direction. The factors dragging the gold prices are

USDJPY-

The yen and gold are 90% positively correlated to each other. USDJPY hits a fresh multi-year high on a strong dollar. It is holding above 111.65, a jump till 112.40 is possible.

US Dollar index-

DXY hits the highest level in 15 weeks on board-based US dollar. Any weekly close above 94 confirms further bullishness.

US 10-year yield- It has slightly cooled off after hitting a high of 1.56%.

Technical:

The immediate resistance is around $1740 and a convincing break above will take the yellow metal $1750/$1760/$1770 if possible. It is facing strong support at $1720, violation below targets $1700/$1675.

It is good to sell on rallies around $1741-42 with SL around $1751 for TP of $1675.