FxWirePro- Gold Daily outlook

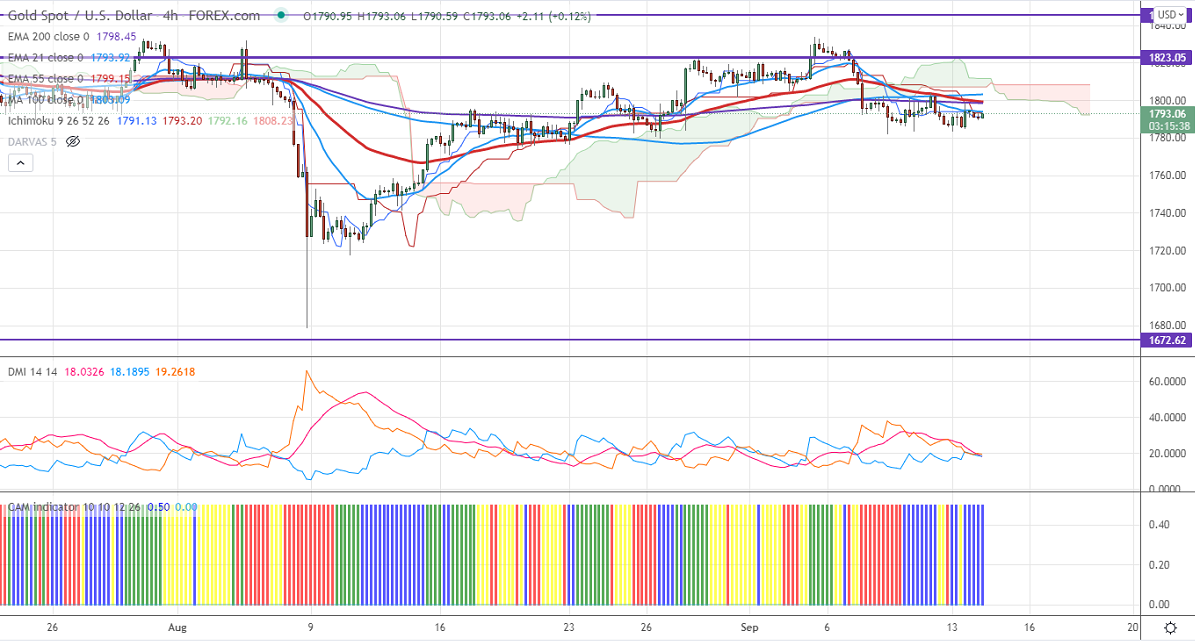

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1791.13

Kijun-Sen- $1793.20

Previous week High- $1830.33

Previous week low- $1782

Gold has shown a minor pullback of more than $10 from a low of $1782. The sell-off in the US dollar index is preventing the yellow metal from further weakness. The US dollar index is hovering near 200-H MA, any breach below 92.55 confirms a bearish continuation. The yellow metal hits an intraday high of $1798 and is currently trading around $1791.62.

Economic data-

Markets eye US CPI data for further direction.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- mixed (neutral for gold)

Technical:

The immediate resistance is around $1810 and a convincing break above will take the yellow metal $1821/$1835/$1850/$1860/$1877/$1900 is possible. It is facing strong support at $1770, violation below targets $1750/$1725.

It is good to sell on rallies around $1818-20 with SL around $1835 for TP of $1750.