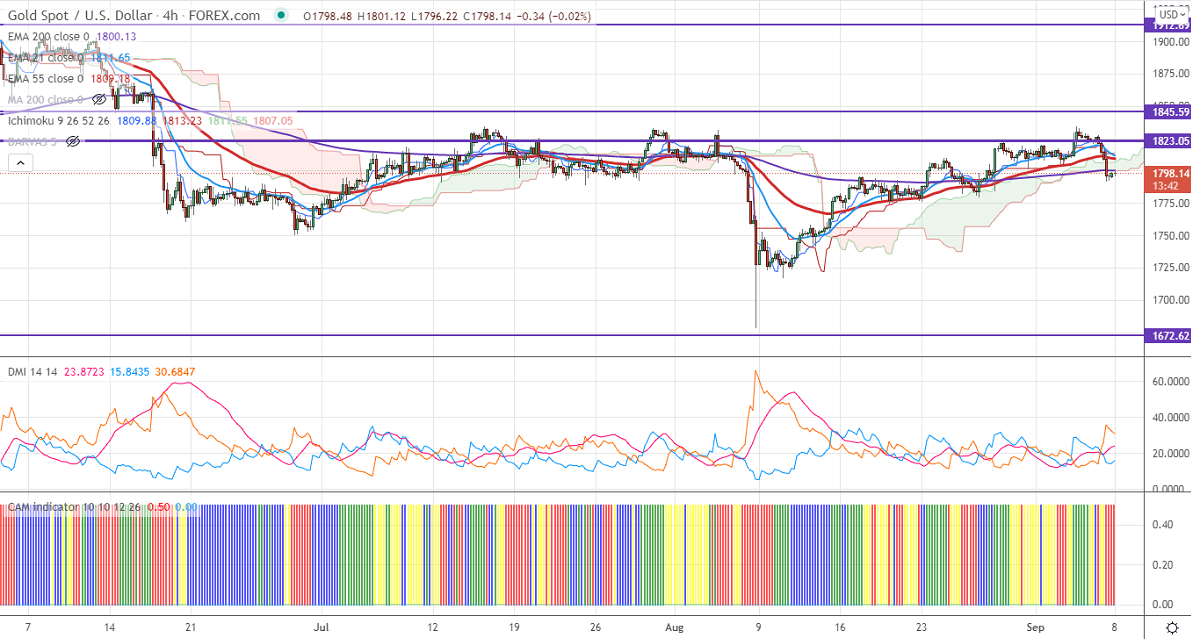

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1826

Kijun-Sen- $1819

Gold has lost more than $30 from the high of $1834 made after dismal US jobs data. The regain in the US dollar index and surging US Treasury yields are putting pressure on the yellow metal at higher levels. The dollar index is holding above 92.50 levels, any breach above 92.60 (200-4H EMA) confirms further bullishness. The yellow metal hits a low of $1792 yesterday and is currently trading around $1798.10.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The immediate resistance is around $1810 and a convincing break above will take the yellow metal $1818/$1835/$1850 if possible. It is facing strong support at $1790, violation below targets $1770/$1750.

It is good to buy on dips for around $1770 with SL around $1758 for TP of $1835.