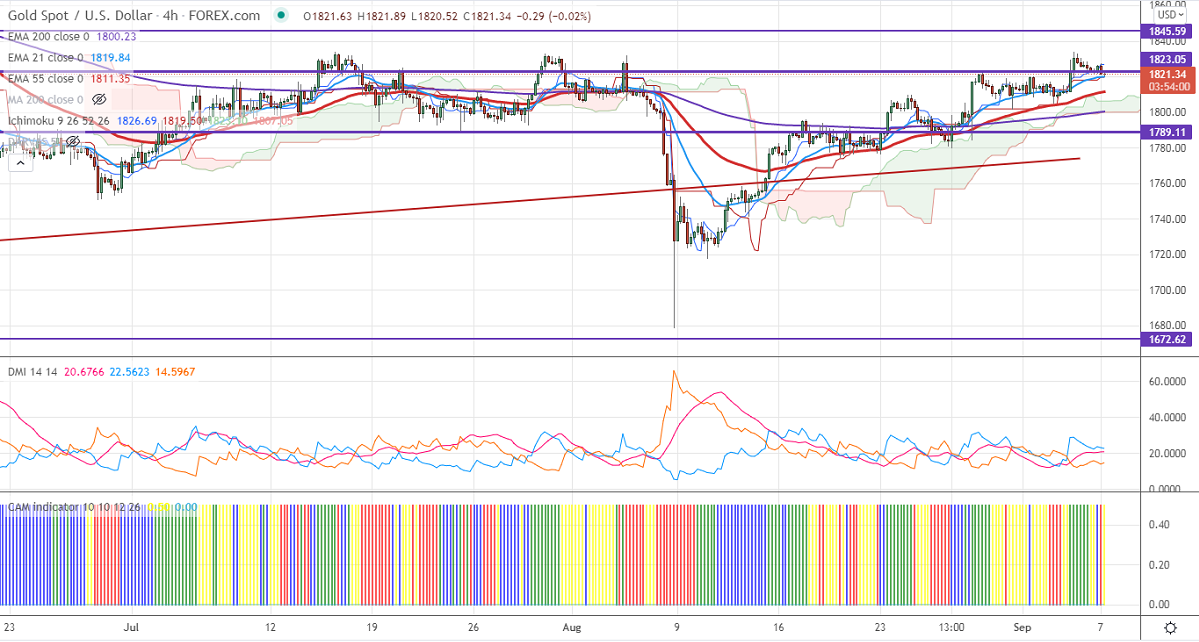

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1826

Kijun-Sen- $1819

Gold trading flat on account of the US holiday yesterday. The weak US dollar is supporting the yellow metals at lower levels. The dollar index declined after a minor pullback to 92.31. Any breach below 91.78 confirms that it has formed a temporary top around 93.72, a dip till 89.20 is possible. The rebound in the US 10-year yield of more than 5.5%. The yellow metal hits an intraday low of $1821 and is currently trading around $1821.50.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The immediate resistance is around $1835 and a convincing break above will take the yellow metal $1850/$1860/$1877/$1900 is possible. It is facing strong support at $1818, violation below targets $1800/$ $1770.

It is good to buy on dips around $1810-11 with SL around $1790 for TP of $1850.