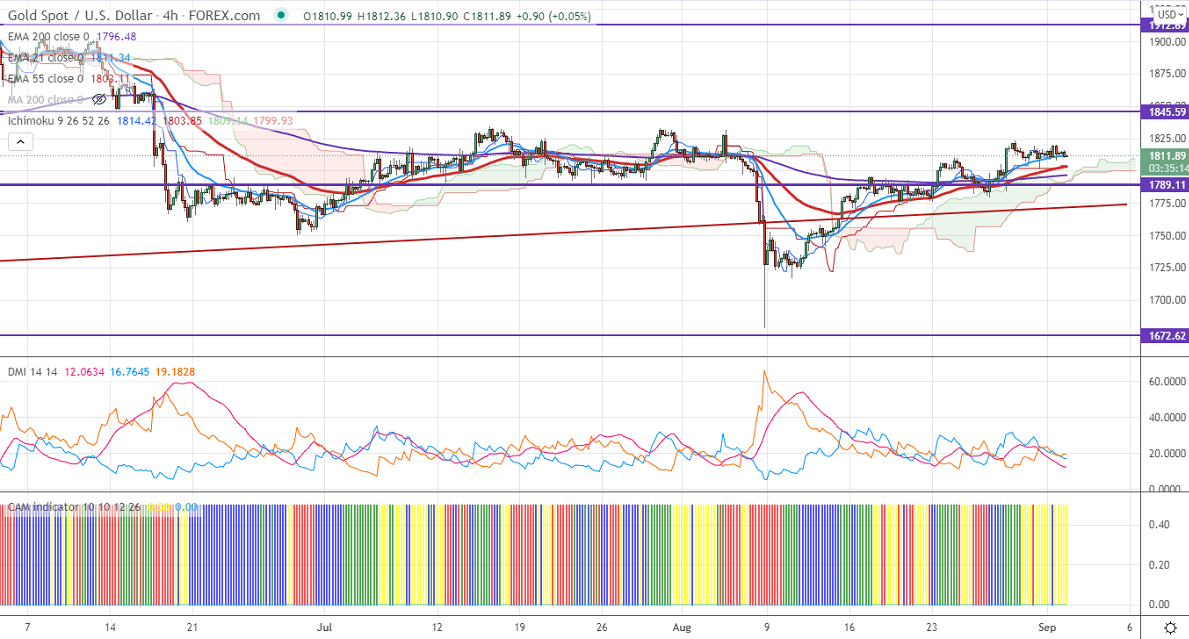

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1814.42

Kijun-Sen- $1803.85

Previous week low- $1770

Gold continues to trade in a narrow range for the past ten days. Investors eye US Nonfarm payroll data which is to be released tomorrow for further direction. The minor weakness in the US dollar despite strong US ISM manufacturing data. It came at 59.9% in August compared to the forecast of 58.5%, increased for the 15th consecutive month. The private payrolls surged to 374000 lower compared to an estimate of 640000.

Economic data-

Markets eye US initial jobless claims for further direction.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- mixed (neutral for gold)

Technical:

The immediate resistance is around $1825 (38.2% fib), a convincing break above will take the yellow metal to $1835/$1850. It is facing strong support at $1770, violation below targets $1750/ $1730/$1700.

It is good to buy on dips around $1800 with SL around $1790 for TP of $1835.