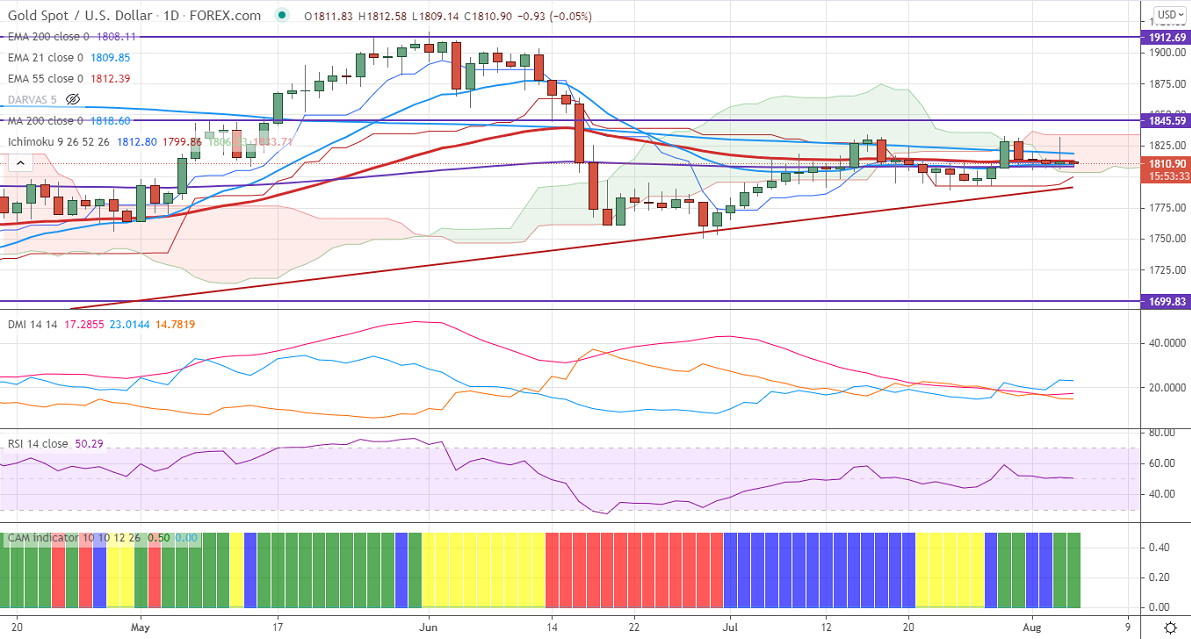

Ichimoku analysis (Daily chart)

Tenken-Sen- $1811.46

Kijun-Sen- $1793.62

Gold lost more than $20 on upbeat US ISM services data. It hits a record high in July at 64.1 compared to a forecast of 60.40. The US dollar gained and holding well above92 level. While US private sector has added 33000 jobs in July well below expectations of 695000. Markets eye US initial jobless claims for further direction.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- weak (positive for gold)

Technical:

It is facing strong support at $1790, violation below targets $1780/$1765. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1821 and a convincing break above will take the yellow metal $1835/$1860/$1900 is possible.

It is good to buy on dips around $1790-91 with SL around $1778 for TP of $1850