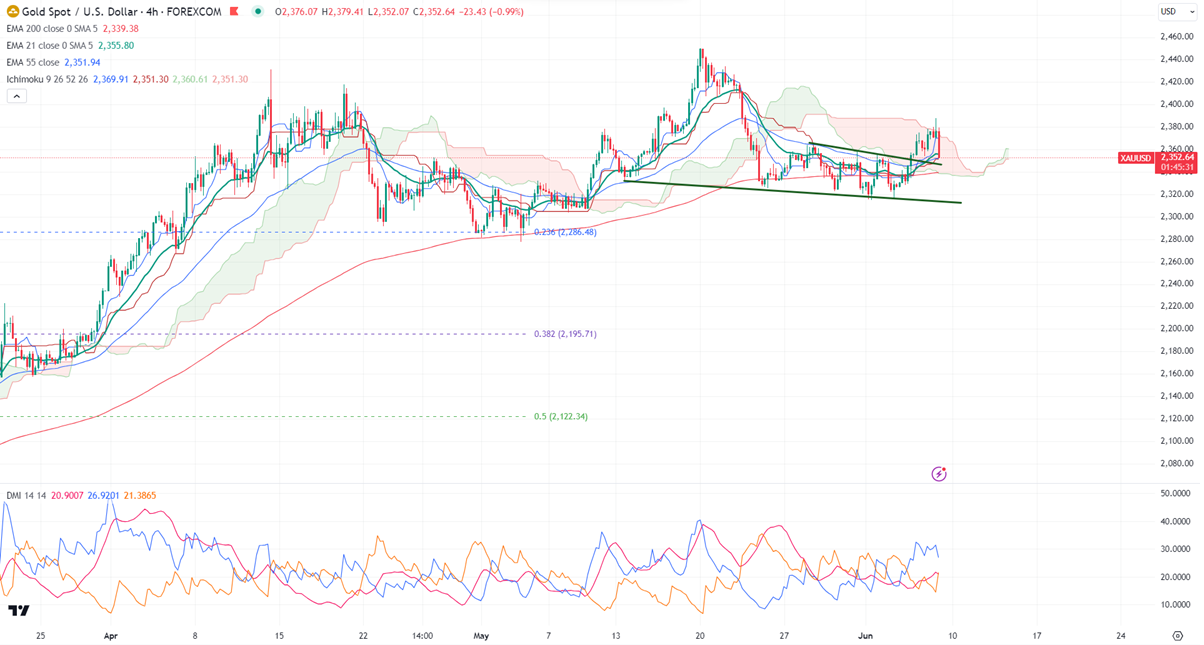

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- $2370

Kijun-Sen- $2351

Gold jumped sharply after ECB monetary policy. It hit a high of $2387 yesterday and is currently trading around $2373.

ECB cuts rates by 25 bpbs to 3.75% for the first time since 2019. Bank Of Canada cuts its rates by 25 bpbs for the first time in four years. The rate cut by major central banks will push the safe-haven assets higher.

US Initial jobless claims - Bearish (positive for Gold)

Markets eye US Non Farm Payroll data for further movement.

According to the CME Fed watch tool, the probability of a no-rate cut in June decreased to 97.50% from 98.90% a week ago.

US dollar index- Bearish. Minor support around 104/103. The near-term resistance is 105/106.50.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Bearish (positive for gold)

US10-year bond yield- Bearish(Positive for gold)

Technical:

The near–term support is around $2340, a break below the target of $2315/$2300/$2285/$2270. The yellow metal faces minor resistance around $2365 and a breach above will take it to the next level of $2375/ $2400/$2420/$2450.

It is good to buy on dips around $2340 with SL around $2315 for TP of $2500.