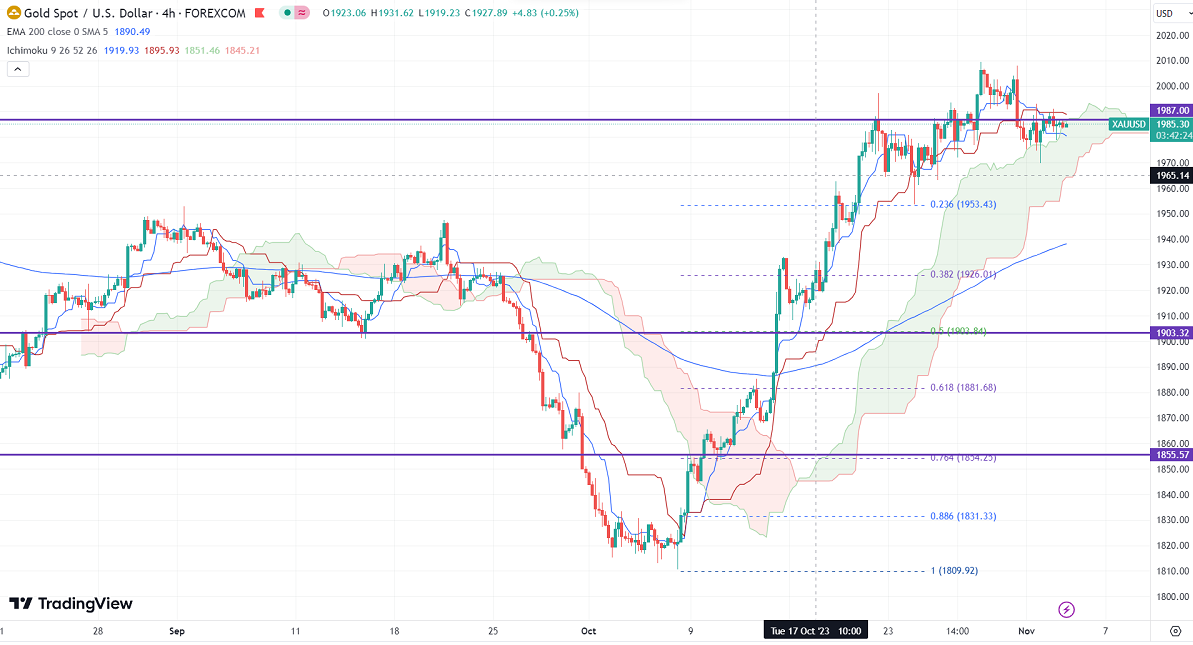

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1981.48

Kijun-Sen- $1989.67

Gold trades flat ahead of US Non-Farm payroll data. It hit a high of $1991.03 yesterday and is currently trading around $1983.75.

The US economy is expected to add 178000 jobs in Oct from 336000 the previous month. Unemployment rate to remain flat at 3.8%.

The number of people who have claimed unemployment benefits rose by 5000 last week to 217000, compared to a forecast of 21000.

Major Economic data for the day

Nov 3rd, 2023, US Nonfarm payroll (12:30 pm GMT)

US dollar index- Bullish. Minor support around 105/104.50. The near-term resistance is 107.50/109.

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 80.4% from 79.5% a day ago.

The US 10-year yield traded weak for the second consecutive day and hit its lowest level since Oct 13th, 2023. The US 10 and 2-year spread widened to -33% from -22%.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index - Bullish (Negative for gold)

US10-year bond yield- Bullish (Negative for gold)

Technical:

The near–term support is around $1975, a break below targets of $1960/$1950/$1926. The yellow metal faces minor resistance around $2010 and a breach above will take it to the next level of $2020/$2048.

It is good to buy on dips around $1970-72 with SL around $1960 for TP of $2000/$2020.