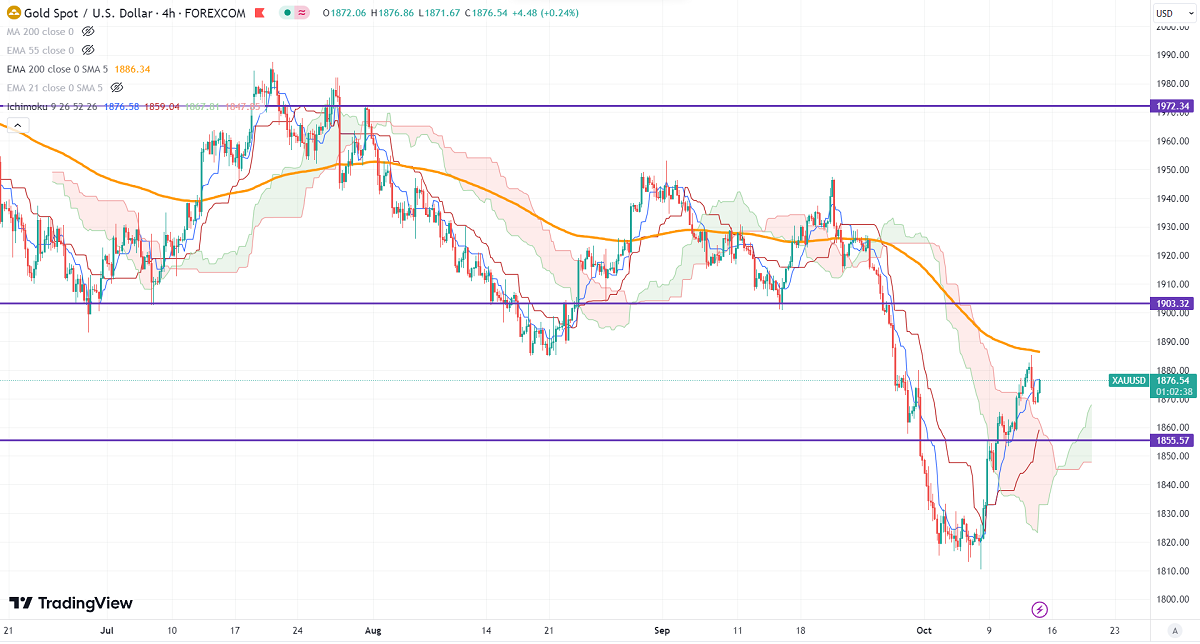

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1876.58

Kijun-Sen- $1857.11

Gold lost its shine after upbeat US inflation. It hit a high of $1885.10 yesterday and is currently trading at around $1874.29.

The US CPI rose 0.40% m/m in Sep 2023 above the estimate of 0.30% and 3.7% a year ago. Core CPI rose 0.30% m/m in Aug and 4.1% YoY. The number of people who have filed for unemployment benefits remains unchanged at 209000 during the week ending on Oct 7th, 2023.

Major economic data for the day

Oct 11th, 2023, prelim UoM Consumer sentiment (2:00 pm GMT)

US dollar index- Neutral. Minor support around 105.80/105. The near-term resistance is 106.60/107.50.

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 90.30% from 79.90% a week ago.

The US 10-year yield showed a minor pullback after positive US CPI data. The US 10 and 2-year spread narrowed to -37.9% from -75%.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index - Mixed (neutral for gold)

US10-year bond yield- Mixed (neutral for gold)

Technical:

The near–term support is around $1865, a break below targets of $1855/$1840/$1830. The yellow metal faces minor resistance around $1880 and a breach above will take it to the next level of $1900/$1920.

It is good to buy on dips around $1862-63 with SL around $1850 for TP of $1900/$1920.