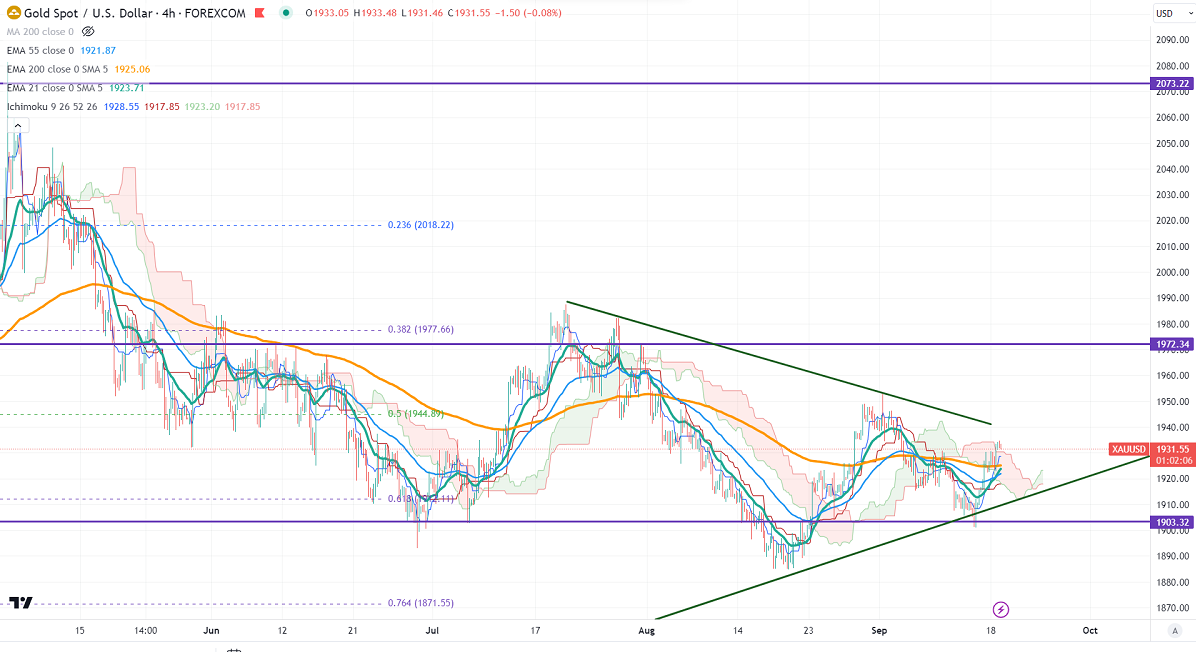

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1928.55

Kijun-Sen- $1917.85

Gold is trading higher for the third consecutive day despite the strong US dollar. It hit a high of $1934.31 and is currently trading around $1932.27.

Markets are subtle and are likely to remain in the consolidated phase till the FOMC meeting.

US dollar index- Bullish. Minor support around 104.40/103.79. The near-term resistance is 105.50/106.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 99% from 92% a week ago.

The US 10-year yield pared some of its gains after hitting a multi-week high. The US 10 and 2-year spread widened to -74.5% from -57%.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Bullish (negative for gold)

US10-year bond yield- Mixed(neutral for gold)

Technical:

The near–term support is around $1900, a break below targets of $1880/$1870/$1850. The yellow metal faces minor resistance around $1920 and a breach above will take it to the next level of $1930/$1950/.

It is good to buy on dips around $1918-20 with SL around $1900 for TP of $1960/$1975.