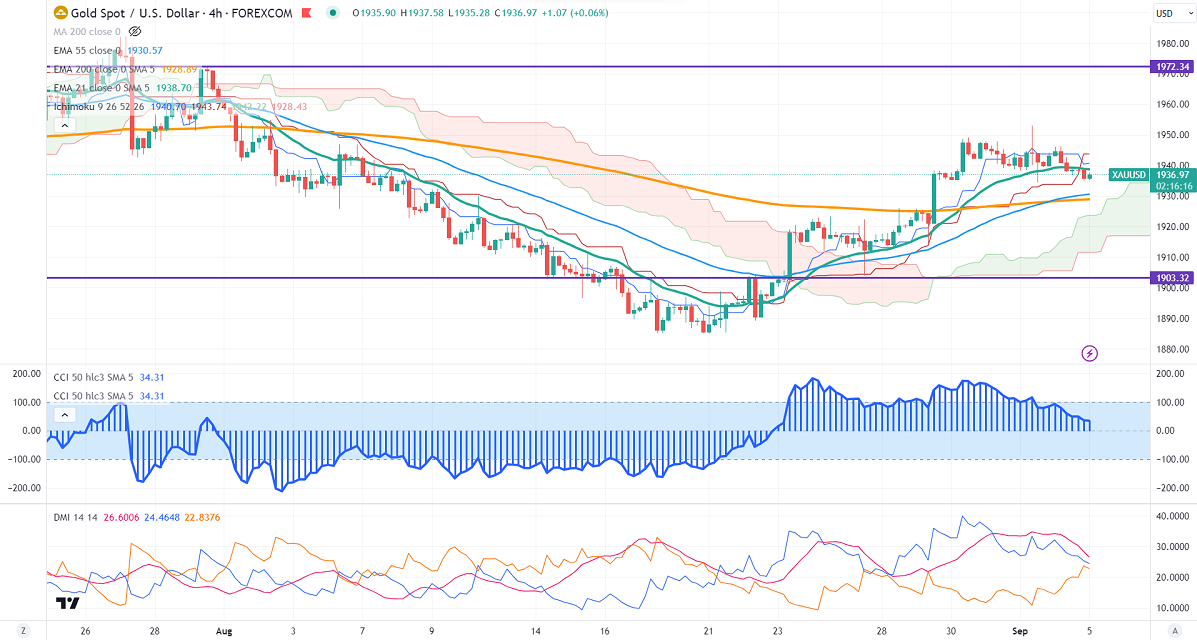

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1940.39

Kijun-Sen- $1943.74

Gold trades slightly lower on profit booking. It hit a low of $1935.07 and is currently trading around $1937.19. The precious metal showed little volatility yesterday on the US and Canadian market holidays.

The yellow metal dropped on Friday after mixed US Nonfarm payroll data. Although the US economy created 187000 jobs in August and unemployment rate rose sharply to 3.8% from 3.6%.

US dollar index- Bullish. Minor support around 103/102. The near-term resistance is 105/106.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 93% from 78% a week ago.

The US 10-year yield trades flat due to the US labor market holiday. The US 10 and 2-year spread narrowed to -69% from -86.4%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bullish (negative for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1933, a break below targets of $1920/$1900. The yellow metal faces minor resistance around $1950 and a breach above will take it to the next level of $1970/$2000.

It is good to buy on dips around $1932-33 with SL around $1920 for TP of $1970/$2000.