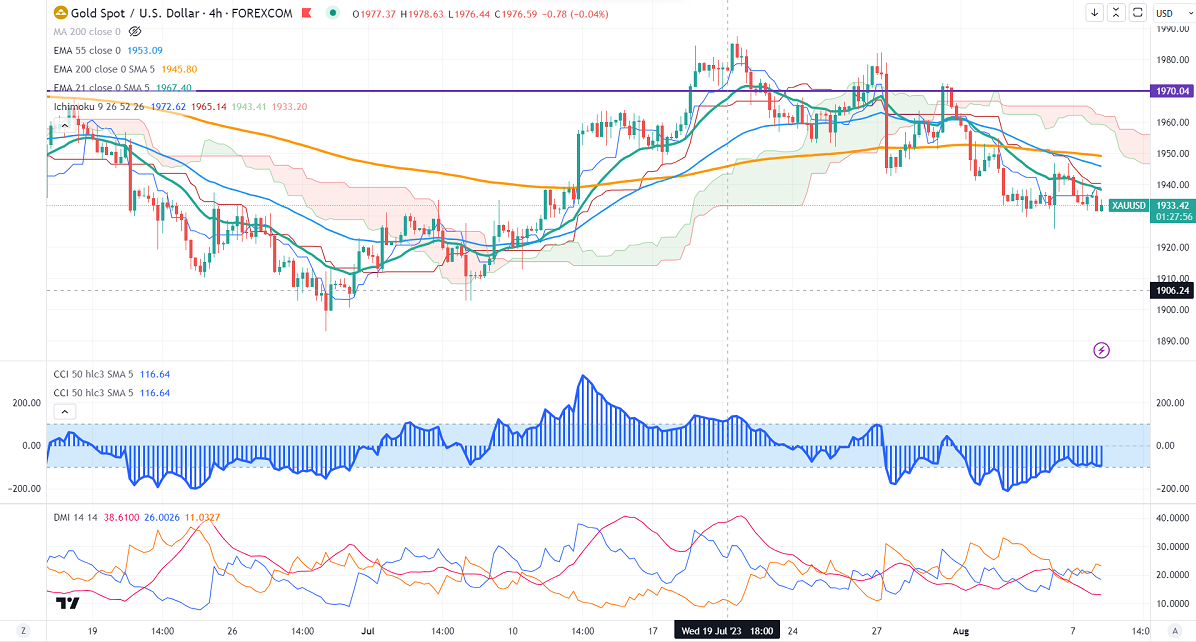

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1939.16

Kijun-Sen- $1940.35

Gold pared some of its gains after a hawkish Fed official speech. It hits a low of $1931.55 yesterday and is currently trading around $1932.91.

Fed governor Michelle Bowman stated that "I also expect that additional rate increases will likely be needed to get inflation on a path down to the FOMC's 2 percent target."

Major economic data for the day

Aug 8th, 2023, FOMC member Harker speech (12:15 pm GMT)

US dollar index- Bullish. Minor support around 102/101. The near-term resistance is 103/104.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 86.50% from 81% a week ago.

The US 10-year yield pared some of its gains despite hawkish fed officials. The US 10 and 2-year spread narrowed to -71 from -110%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bullish (bearish for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1920, a break below targets of $1900/$1885. The yellow metal faces minor resistance around $1950 and a breach above will take it to the next level of $1955/$1970/$1985.

It is good to sell on rallies around $1950 with SL around $1960 for TP of $1900.