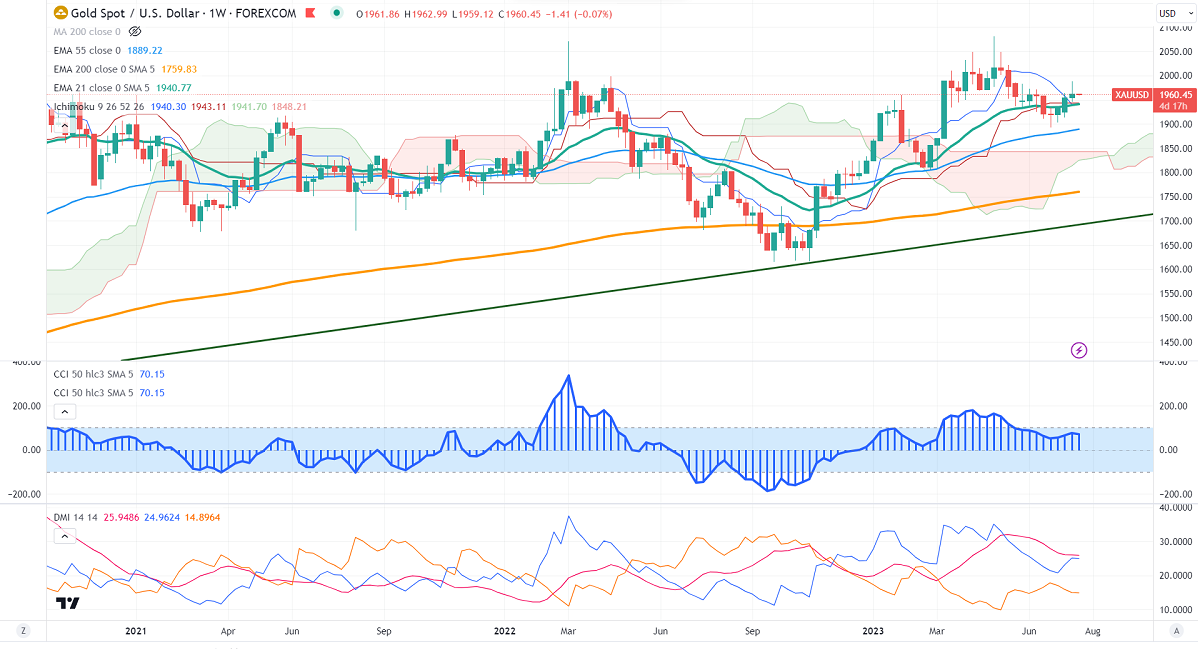

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1940.30

Kijun-Sen- $1943.11

Gold prices pared some of their gains on the strong US dollar. It hits a low of $1956.90 and currently trading around $1959.65.

US retail sales rose 0.20% last month, below the forecast of 0.40%. Retail sales ex-autos came at 0.20% vs an estimate of 0.30% (positive for gold).

The number of people who have filed for unemployment benefits declined to 228000 in the week ending July 15th, compared to a forecast of 242K (negative for Gold). US Philly fed manufacturing index dropped to -13.50 vs.-10 expected (positive for gold).

US housing starts declined by 8% to a seasonally adjusted annual rate of 143000 and building permits fell 3.7% down to 1.44M.

US dollar index- weak. Minor support around 99.50/98. The near-term resistance is 100.60/102.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 99.80% from 96.70% a week ago.

The US 10-year yield showed a minor pullback on mixed US economic data. The US 10 and 2-year spread narrowed to -100% from -110%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - mixed (Neutral for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1950, a break below targets of $1945/1930. The yellow metal faces minor resistance around $1965, and a breach above will take it to the next level of $1980/$2000.

It is good to buy on dips around $1950 with SL around $1938 for TP of $1990/$2000.