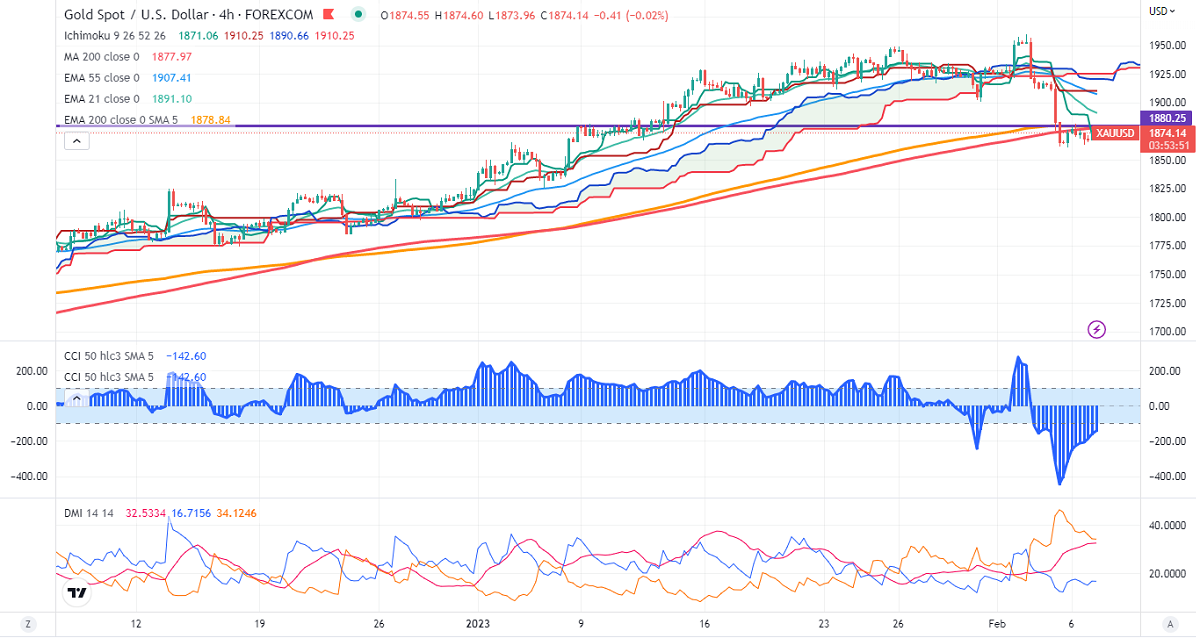

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1871.25

Kijun-Sen- $1910.25

Gold formed a double bottom near $1860 and showed a minor pullback. Markets eye US Fed Chairman Powell's speech today for further direction. Any hawkish comments from Fed Chairman will dag gold prices lower to $1850. The yellow metal was one of the worst performers the previous week on upbeat US jobs data. It hits a low of $1863.13 yesterday and is currently trading around $1874.67.

US dollar index- Bullish. Minor support around 101.50/100.80. The near-term resistance is 104/105.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb rose to 95.20 from 83.90% a week ago.

The US 10-year yield traded higher for the second consecutive day. Any break and close above 3.63% confirm minor bullishness. The yield spread between 10 and 2-year widened to -81.30 basis points from -72.40 bpbs.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index – Bullish (Bearish for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1860, a break below targets of $1845/1828/$1800. The yellow metal faces minor resistance around $1880, and a breach above will take it to the next level of $1900/$1925/$1950.

It is good to sell on rallies around $1900 with SL around $1925 for TP of $1800.