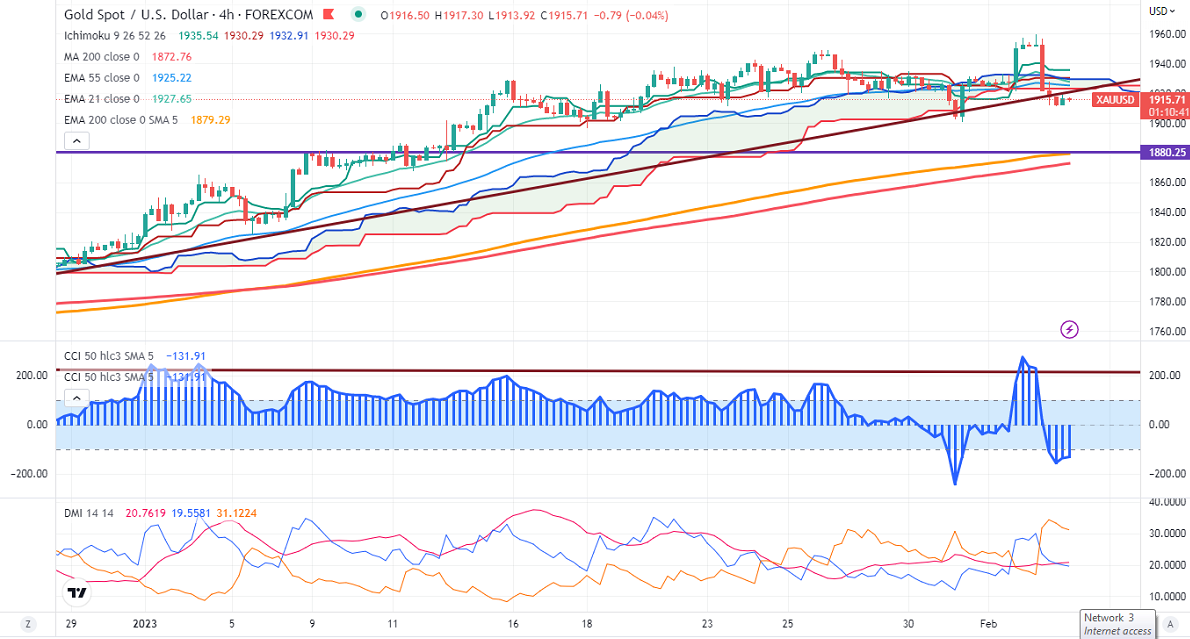

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1935.54

Kijun-Sen- $1930.27

Gold pared some of its gains on profit booking. The yellow metal spiked sharply to $1959 after a less hawkish rate hike by Fed. But the European central bank hiked rates by 50 bpbs again yesterday and hinted at more hikes in Mar. the yellow metal lost its shine after a hawkish tone from ECB President. It hits a low of $1911 yesterday and is currently trading around $1915.71.

The number of people who have filed for unemployment benefits dropped by 3000 to 183000 week ended Jan 28, the lowest level since Apr 2022. Markets eye US NFP data for further direction.

US dollar index- Bullish. Minor support around 101.50/100.80. The near-term resistance is 102.60/103.50.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb dropped to rose to 85.6 from 85.3% a week ago.

The US 10-year yield declined slightly after the Fed policy. Any break and close below 3.26% confirm minor bearishness. The yield spread between 10 and 2-year narrowed to -72.40 basis points from -75 bpbs.

Factors to watch for gold price action-

Global stock market- bearish (Positive for gold)

US dollar index – Bullish (Bearish for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1900, a break below targets of $1890/$1870.The yellow metal faces minor resistance around $1920, and a breach above will take it to the next level of $1960/$2000/$2025.

It is good to buy on dips around $1920-21 with SL around $1900 for TP of $2000.